Reichert v. Keefe Commissary Network, WA, Amended Complaint, Debit Release Cards, 2019

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

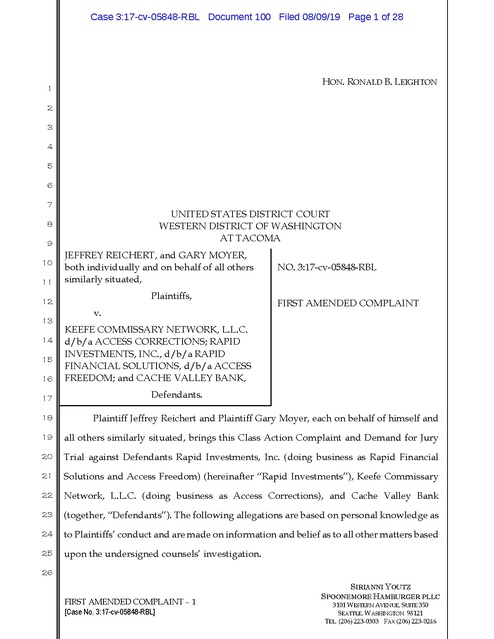

Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 1 of 28 HON. RONALD B. LEIGHTON 1 2 3 4 5 6 7 UNITED STATES DISTRICT COURT WESTERN DISTRICT OF WASHINGTON AT TACOMA 8 9 10 11 JEFFREY REICHERT, and GARY MOYER, both individually and on behalf of all others similarly situated, Plaintiffs, 12 13 14 15 16 17 v. NO. 3:17-cv-05848-RBL FIRST AMENDED COMPLAINT KEEFE COMMISSARY NETWORK, L.L.C. d/b/a ACCESS CORRECTIONS; RAPID INVESTMENTS, INC., d/b/a RAPID FINANCIAL SOLUTIONS, d/b/a ACCESS FREEDOM; and CACHE VALLEY BANK, Defendants. 18 Plaintiff Jeffrey Reichert and Plaintiff Gary Moyer, each on behalf of himself and 19 all others similarly situated, brings this Class Action Complaint and Demand for Jury 20 Trial against Defendants Rapid Investments, Inc. (doing business as Rapid Financial 21 Solutions and Access Freedom) (hereinafter “Rapid Investments”), Keefe Commissary 22 Network, L.L.C. (doing business as Access Corrections), and Cache Valley Bank 23 (together, “Defendants”). The following allegations are based on personal knowledge as 24 to Plaintiffs’ conduct and are made on information and belief as to all other matters based 25 upon the undersigned counsels’ investigation. 26 FIRST AMENDED COMPLAINT – 1 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 2 of 28 I. INTRODUCTION 1 1. Defendants Keefe Commissary Network, LLC (“Keefe”), Rapid 2 Investment Solutions (“Rapid”) and Cache Valley Bank (“Cache Valley”) have 3 individually, and at times together, exploited plaintiffs and members of the class at their 4 darkest hour – when they were arrested and subsequently released from jail. Typically, 5 when people are arrested, the cash they have on hand is confiscated by the facility where 6 they are initially held. In the past, the cash was returned to those arrested upon release, 7 or, at the very least, a check was provided for the exact amount of cash. Defendants saw 8 the opportunity to make a money off of this straightforward transaction, solely at the 9 expense of those released. 10 2. Defendants’ scheme is simple: They would relieve local jails of any 11 obligation to hold, track and account for funds of people while in a facility, at no expense 12 to the facility. All the facilities needed to do was deposit the funds with Defendants 13 upon the person’s arrest, and then hand out the debit cards to those released; Defendants 14 would manage the rest. When the person is released, they are given Defendants’ 15 activated debit card. Defendants then imposed various excessive fees on plaintiffs and 16 the classes they represent. 17 3. Plaintiff Jeffrey Reichert was arrested by Kitsap County officers on October 18 21, 2016 during a drive home from work. Mr. Reichert was jailed for just four hours at 19 the Kitsap County Jail. Upon his arrest, Kitsap County officers confiscated 20 approximately $177.66 in cash. When released, Mr. Reichert involuntarily received 21 Defendants’ prepaid debit card loaded with the confiscated amount instead of the cash 22 that had been confiscated. The card was already activated by Defendants when given to 23 him. Before he could get his money back, Defendants took over $17 in unwarranted fees. 24 25 26 FIRST AMENDED COMPLAINT – 2 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 3 of 28 1 4. Plaintiff Gary Moyer was arrested in Kitsap County, Washington. Upon 2 his arrest, all of Mr. Moyer’s cash on his person was confiscated by Kitsap County 3 officers. When he was released from Kitsap County jail in February of 2019, he did not 4 receive money in the form of cash. Mr. Moyer was involuntarily provided with a prepaid 5 debit card. Pursuant to Kitsap County’s standard policy in February of 2019, the card, 6 when provided to Mr. Moyer, was “sealed in the Cardholder Terms and Conditions.” 7 The card was already activated when given to him. Mr. Moyer’s card was issued by one 8 or more of the Defendants. He also had to pay unwarranted fees before obtaining the 9 return of his money. 10 5. Defendants have engaged in a pattern of unlawful, deceptive, unfair, and 11 unconscionable profiteering with respect to the activated prepaid release cards that 12 individuals who are released from jails and prisons receive involuntarily. In so doing, 13 Defendants have violated the Electronic Fund Transfer Act, 15 U.S.C. §1693, and, for the 14 Washington Subclass, the Washington Consumer Protection Act, RCW 19.86. 15 addition, for the Washington Subclass, Defendants have committed an unlawful taking 16 of property under the Fifth Amendment, converted funds and have been unjustly 17 enriched by their conduct. 18 19 In II. THE PARTIES 6. Plaintiff Jeffrey Reichert lives in and is a citizen of Kingston, Washington. 20 Mr. Reichert involuntarily received an activated, fee-laden debit card issued by one or 21 more of the Defendants when he was released from Kitsap County Jail. He did not 22 receive a “terms and conditions” sheet with the card. 23 7. Plaintiff Gary Moyer lives in and is a citizen of Port Orchard, Washington. 24 Mr. Moyer involuntarily received an activated, fee-laden debit card issued by one or 25 more of the Defendants when he was released from Kitsap County Jail. Consistent with 26 FIRST AMENDED COMPLAINT – 3 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 4 of 28 1 Kitsap County’s standard practice in February of 2019, he received a “terms and 2 conditions” sheet with the card. 3 8. Defendant Keefe Commissary Network, L.L.C. (“Keefe”), a subsidiary of 4 Keefe Group, Inc., is a Missouri corporation that does business under various trade 5 names, including “Access Corrections.” Keefe Group, Inc.’s annual revenue totals $1 6 billion. Keefe is the nation’s biggest operator of commissary stores inside correctional 7 facilities and offers a wide array of services to correctional institutions, including prepaid 8 debit release cards. Keefe contracted with Kitsap County to provide correctional 9 commissary services to the County, including an inmate release prepaid debit card 10 program that was provided through a third-party company, Rapid Investments, Inc. 11 Keefe is located at 10880 Linpage Place, St. Louis, Missouri 63132. 12 9. Defendant Rapid Investments is a Utah corporation that does business as 13 Rapid Financial Solutions and other various trade names, including “Access Freedom.” 14 Rapid Investments states on its website that “the Rapid Processing Engine is designed 15 to help your company process a variety of digital transactions including: direct deposit, 16 payroll cards, prepaid debit cards, wire transfers, mobile payments, structured 17 payments, and e-checks.” Rapid Investments markets its prepaid cards to government 18 entities, including Kitsap County, financial institutions, and other private enterprises. 19 These entities in turn disseminate Rapid Investments’ products to the general public. 20 Rapid Investments contracted with Keefe to provide AccessFreedom cards to 21 individuals being released from Kitsap County Jail. Rapid Investments is located at 3065 22 North 200 West, Ste. 200, North Logan, Utah 84341. 23 10. Defendant Cache Valley Bank is a state chartered bank based in Utah. 24 Cache Valley Bank is a member of the Federal Deposit Insurance Corporation and has 25 over $950 million in assets and 13 offices throughout Utah. Cache Valley Bank has 26 FIRST AMENDED COMPLAINT – 4 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 5 of 28 1 contracted with Rapid Investments to issue prepaid debit cards nationwide and is 2 located at 101 N. Main, Logan, Utah 84321. 3 III. JURISDICTION AND VENUE 11. 4 This Court has jurisdiction over the subject matter of this action pursuant 5 to 28 U.S.C. § 1331 because this is a civil action arising under the laws of the United 6 States, namely 42 U.S.C. § 1983 and 15 U.S.C. §1693. 12. 7 8 This Court may exercise supplemental jurisdiction over state law claims pursuant to 28 U.S.C. § 1367. 13. 9 Venue is proper in this District pursuant to 28 U.S.C. § 1391 because each 10 Defendant is subject to personal jurisdiction in this District and a substantial part of the 11 events or omissions giving rise to the claim occurred within this District. 12 13 14 IV. FACTS A. Background 14. Over 650,000 individuals are released from state and federal prisons 15 annually. Local jails nationwide process an estimated 11.6 million people each year. The 16 vast majority of these inmates are released from custody shortly after they are booked. 17 Most of the people released from jails are never convicted of any crime. 18 a. Keefe is one of many for-profit players in an increasingly privatized 19 prison industry. State spending alone on corrections hit $52.4 billion in 2012. 20 Hundreds of private sector contractors now provide food, clothing, riot gear, 21 phone service, computers, and health care, in addition to directly operating many 22 correctional facilities. 23 24 b. At least 10 companies, including Rapid Investments, now offer prepaid release cards to correctional systems. 25 26 FIRST AMENDED COMPLAINT – 5 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 6 of 28 15. 1 Kitsap County, like all jails, prisons, and detention facilities, keeps an 2 individual’s confiscated cash until his or her release. These funds are held in trust with 3 the understanding that the State will protect the property on the individual’s behalf. 16. 4 Traditionally, when inmates were released from jails, prisons, and other 5 detention facilities, their jailers returned to them in the form of cash or check any cash 6 that the jailers confiscated at booking. The jailers also traditionally returned to them, in 7 the form of cash or check, any monies that had accrued in the individual’s inmate trust 8 account. 17. 9 According to a 2014 Association of State Correctional Administrators 10 survey, government agencies across the United States that handle inmate funds are 11 increasingly using prepaid debit cards to return personal funds to former inmates. Over 12 half of responding agencies reported using prepaid debit cards to return inmates’ 13 property, and a majority of those agencies reported that a fee is charged when using the 14 debit card to get cash from a bank.1 18. 15 Unlike typical consumers, released individuals are not given the choice to 16 accept a fee-laden financial product like the AccessFreedom Card, and they never fill out 17 an application for this financial product. 19. 18 Moreover, the typical released individual suffers from poor financial 19 literacy. A study by the University of Arkansas-Little Rock Anderson Institute on Race 20 and Ethnicity of Inmates in Arkansas found that only 33.1 percent of inmates could 21 correctly answer the question, “If you put $100 in a bank account paying 5 percent 22 23 24 1 25 26 See Proposed Amendments to Regulation E: Curb exploitation of people released from custody, Prison Policy Initiative 2, March 18, 2015, https://static.prisonpolicy.org/releasecards/CFPBcomment.pdf (last visited October 20, 2017). FIRST AMENDED COMPLAINT – 6 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 7 of 28 1 interest, how much will you have in your account after one year?” In contrast, 79.6 2 percent of non-incarcerated men got the same question right.2 20. 3 That Defendants market financial products rife with fees—all so released 4 individuals can access their own money—is both predatory, unfair, and deceitful. 5 B. Kitsap County’s Inmate Release Card Program 21. 6 Kitsap County contracted with Keefe (formerly known as Keefe Supply 7 Company) as early as January 1, 2007 for myriad correctional commissary services, 8 including fair market pricing of goods for inmates, an inmate banking system, inmate 9 commissary order processing, as well as other services. 22. 10 The contract for correctional commissary services was subsequently 11 renewed on various occasions, and in March 2012, Kitsap County entered into an 12 agreement with Keefe for provision of prepaid debit cards to all released inmates. Under 13 the contract, Keefe may change the card brand, issuing bank, or program manager at any 14 time without the County’s approval. Keefe’s first contract with Kitsap County listed 15 OutPay Systems, L.L.C. as the prepaid debit card manager and First California Bank as 16 the issuing bank. Since the initial 2012 contract, Keefe has switched to Rapid Investments 17 as the card manager and brand, and Cache Valley Bank as the issuing bank. 23. 18 Under the Keefe contract and its amendments, the Kitsap County Sheriff’s 19 Office implemented Defendants’ inmate release card program to perform the traditional 20 government service of returning money relinquished by inmates at booking. 24. 21 22 By no later than March 2012, Kitsap County began providing prepaid debit cards to released inmates, in lieu of a check. The cards were activated prior to being given 23 24 25 26 2 David Koon, ARKANSAS TIMES, New UALR survey finds a lack of basic ‘financial literacy’ among inmates, https://www.arktimes.com/arkansas/new-ualr-survey-finds-a-lack-of-basic-financial-literacyamonginmates/Content?oid=3351524, June 19, 2017 (last visited October 20, 2017). SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC FIRST AMENDED COMPLAINT – 7 3101 WESTERN AVENUE, SUITE 350 [Case No. 3:17-cv-05848-RBL] SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 8 of 28 1 to the released inmate. By February of 2019, Kitsap County would provide the cards to 2 released inmates along with a copy of the “Cardholder Terms and Conditions.” 25. 3 Rapid Investments’ prepaid card services reach over 2 million consumers 4 and span at least nine different prepaid card programs, including programs for 5 correctional facilities.3 26. 6 Rapid Investments contracts with third party commissary companies like 7 Keefe who, in turn, contract with detention facilities to provide prepaid card programs 8 to various city, county, and state agencies. 27. 9 10 bank for its cards, and with MasterCard as the payment network sponsor. 28. 11 12 Rapid Investments also contracts with Cache Valley Bank as an issuing Keefe, Rapid Investments and Cache Valley Bank all work together, coordinate efforts and share fees. 29. 13 Kitsap County chose to subcontract out its inmate property release system 14 in order to save the personnel time and money associated with check re-issuances, stop 15 payments, fraud prevention, and checking account maintenance. 30. 16 Kitsap County accepted Keefe’s assignation of the County’s duties and 17 contracted with Defendants to provide the inmate release card program. Pursuant to that 18 contract, Defendants enjoy a monopoly at the Kitsap County Jail. 31. 19 20 Kitsap County Sheriff’s Office Chief of Corrections, Ned Newlin, entered into the contract for prepaid debit card services with Defendant Keefe. 21 22 23 24 3 25 26 Rapid Financial Solutions Partners with Digiliti Money to Deliver Mobile Money Solutions to More Than 2 Million Cardholders, https://www.digilitimoney.com/news/press-releases/rapid-financialsolutions-partners-withdigiliti-money-to-deliver-mobile-money-solutions-to-more-than-2-millioncardholders, July 20, 2016 (last visited October 20, 2017). SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC FIRST AMENDED COMPLAINT – 8 3101 WESTERN AVENUE, SUITE 350 [Case No. 3:17-cv-05848-RBL] SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 9 of 28 32. 1 Per their contract, Defendant Keefe serves as Kitsap County’s contractor 2 for prepaid debit card services, and Keefe may choose the card branding, issuing bank, 3 or prepaid debit card release program manager at its discretion. 33. 4 On information and belief, before contracting with Defendants for 5 maintenance and operation of its release card program, Kitsap County shouldered the 6 costs associated with the management of the inmate property program and its fiscal 7 operations. 34. 8 9 10 11 12 Prior to Defendants’ involvement, the County did not return an inmate’s cash via a debit card. Instead, released inmates received their funds via a County-issued check. 35. The County agreed to use the AccessFreedom Card in releasing inmates with as little as $0.01. 13 36. AccessFreedom Cards can be loaded with up to $9,700. 14 37. However, the County still issues checks to released inmates when the 15 inmate is transferred to another facility; when the inmate chooses to release his/or her 16 funds to someone else; when the inmate chooses to use his/her funds to post bail; or if 17 Keefe’s debit card equipment is not operational. 18 38. The cards are issued with stickers that say, “ATTENTION! This card has 19 already been activated. Your PIN = 7###.” Thus, the cards are activated and ready for 20 immediate use when released inmates receive them. Card recipients who receive the 21 card do not assign their own PIN to the card. 22 39. To resolve problems with the cards such as money being put on the wrong 23 person’s account, Defendants have instructed Kitsap County to simply transfer money 24 off the card of one individual and onto the card of another, whether or not they are in 25 custody. Or if a card was not received by the inmate, but left on the counter, Defendants 26 instructed Kitsap County to void the card and add it to a “destroy log.” FIRST AMENDED COMPLAINT – 9 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 10 of 28 40. 1 2 Kitsap County Jail has over 500 beds and maintains an average daily inmate population of 400. 41. 3 These prepaid release cards are extremely profitable for Defendants, who 4 charge their unwitting and unwilling customers exorbitant fees to possess and/or use 5 the cards. 6 42. According to the contract between Keefe and Kitsap County, Defendants 7 charge a fee for their role in setting up the bank account with the bank issuing the cards 8 and for coordinating third party processing services. These so-called “Coordination 9 Fees” are embedded in the fee structure selected by Kitsap County and the other 10 government entities for the cards, and all fees are assessed to the card holder/inmate. 43. 11 These user fees taken from cardholders are well in excess of the 12 Defendants’ costs and are unreasonable and/or unrelated to the administration of each 13 account. 44. 14 15 present several potential fee schedules, though the services offered remain the same. 45. 16 17 When Defendants market their services to government entities, they Rapid Investments publicizes at least two fee schedules for jails and correctional facilities to choose from.4 46. 18 Of these two offered fee schedules, Kitsap County has chosen the more fee- 19 laden, with higher “weekly maintenance” fees starting just 72 hours after release, and 20 more expensive ATM fees. 47. 21 22 That Defendants offer multiple fee schedules for the same service indicates that the fees are not cost-based, but instead a bald-faced profit mechanism. 23 24 25 26 4 Cardholder Fees, http://www.accessfreedomcard.com/releasefees.html (last visited October 20, 2017). FIRST AMENDED COMPLAINT – 10 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 11 of 28 1 48. Upon information and belief, during negotiations between the contracting 2 government entity and Keefe and its subcontractors, the public entity selects an 3 applicable fee schedule. 4 5 6 7 8 49. Kitsap County negotiated the fee schedule that applies for various uses of the AccessFreedom Card. These fees were imposed on Plaintiffs and the putative Class. 50. Defendants impose a variety of fees for their inmate release card program in Kitsap County. 51. The president of Rapid Investments, Daren Jackson, insists that the 9 company “provides a nice service, a convenient way for someone to get cash 24/7.”5 Yet 10 this “nice service” is far from “convenient.” For inmates in need of immediate cash to 11 pay for a taxi after release, for example, their money is simply not accessible because 12 they likely cannot access their cash through ATMs. 13 52. Inmates with $22.94 or less in their accounts cannot access their money 14 because, assuming the inmate uses an ATM without its own fees, after Defendants’ $2.95 15 ATM fee, the account balance dips below $20—the minimum withdrawal amount at 16 nearly every ATM machine. These low-balance cards are not just particularly lucrative 17 for Defendants; they are also uniquely burdensome on the cardholder. 18 53. Any claims by Defendants that the cards benefit consumers ignores the 19 reality that the individual’s cash has been exchanged for a prepaid debit card that incurs 20 fees mere hours after receipt. In short, an individual’s money is taken from them in the 21 form of exorbitant fees, and the cards plainly lack the utility of the confiscated cash. 22 23 54. On information and belief, individuals who are deported after their arrest and released back in their home country may not be able to access their funds at all— 24 25 26 5 NBC NEWS, March 24, 2015, http://www.nbcnews.com/business/consumer/inmates-charged-fee- after-leavingjail-n329151 (last visited October 20, 2017). FIRST AMENDED COMPLAINT – 11 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 12 of 28 1 even before the $3.95 international ATM fee. Many released individuals report that 2 prepaid debit cards and/or their PIN numbers do not work abroad, or that limits on 3 international ATM withdrawals force them to accrue additional withdrawal fees. 55. 4 Defendants can charge and collect these exorbitant fees because their 5 exclusive contracts with government entities shield them from competitive market forces 6 and because they have absolute control over the funds once the funds are transferred to 7 them by the government entity. 56. 8 Individuals who are released from Kitsap County Jail do not voluntarily 9 engage the company, enroll in the program, or take any affirmative steps to form any 10 contractual relationship with Rapid Investments, Keefe, Cache Valley Bank, or 11 MasterCard. They have no choice but to accept an AccessFreedom Card in lieu of 12 receiving the return of their own money in the form of cash or check. If a released inmate 13 refuses to accept an AccessFreedom Card, they simply lose their money as the balance is 14 depleted by imposition of the fees. 15 C. Plaintiffs’ Experiences 16 57. Mr. Reichert resides in Kingston, Washington. 17 58. For the last 31 years he has worked as a research test mechanic for the 18 Boeing Company. 19 20 21 22 23 24 25 26 59. He was arrested by the Kitsap County, Washington, Sheriff on October 21, 60. Kitsap County confiscated $177.66 in cash and coins from Mr. Reichert 2016. when he was arrested. 61. As his representative, Kitsap County Jail accepted Plaintiff Reichert’s cash and deposited it in a trust account. 62. After approximately four hours in Kitsap County’s custody, Plaintiff Reichert was released around 5 a.m. on October 22, 2016. FIRST AMENDED COMPLAINT – 12 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 13 of 28 63. 1 Upon his release, he received his personal effects back, but he did not get 2 his cash and coins. Instead, a Kitsap County Jail officer gave him an activated prepaid 3 debit release card loaded with the confiscated amount. 64. 4 The prepaid Mastercard Mr. Reichert received from Kitsap County Jail 5 bore the insignia “AccessFreedom Member,” the brand name of the AccessFreedom 6 Card, and was issued by Cache Valley Bank. 65. 7 Plaintiff Reichert was not given any paperwork explaining the card; nor 8 did anyone from Kitsap County explain how to use the card or why he was being given 9 the piece of plastic in lieu of his cash. When Mr. Reichert asked the releasing officer for 10 his cash, the officer replied, “oh, you don’t get your cash back, you get a debit card.” 11 When Mr. Reichert asked how the card worked the officer informed Mr. Reichert that he 12 needed to “put these set of numbers in” to get it to work, referring to his PIN number. 66. 13 Plaintiff Reichert was released around 5 a.m. into a parking lot with no 14 jacket. He called a cab and managed to persuade the cab driver that he would pay them 15 when they arrived at his home. He could not use the AccessFreedom Card for his cab 16 fare. 17 67. Mr. Reichert would rather have received his cash back, but Kitsap County 18 Jail forced the prepaid card upon him without presenting any alternatives. Mr. Reichert 19 was never asked whether he wished to receive his monies in cash or in the form of a 20 prepaid debit card for which he would be assessed various exorbitant, unreasonable fees. 21 68. Mr. Reichert never applied for the AccessFreedom Card. 22 69. Mr. Reichert never agreed to receive the AccessFreedom Card instead of 23 24 25 his cash and never assented to the terms to any contract with Defendants. 70. Mr. Reichert had no choice but to accept the AccessFreedom Card instead of his cash. Mr. Reichert could not meaningfully object to receiving the prepaid debit 26 FIRST AMENDED COMPLAINT – 13 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 14 of 28 1 card. Mr. Reichert’s receipt of his cash back in the form of the AccessFreedom Card was 2 completely and utterly involuntary. 3 71. Just three days after his release, on October 25, 2016, $2.50 was taken from 4 his AccessFreedom Card balance for a weekly maintenance fee. Another $2.50 weekly 5 maintenance fee was assessed a week later, on November 1, 2016. 6 72. On November 2, 2016, Mr. Reichert visited his local branch of the Kitsap 7 County Credit Union to try to access his funds. At the bank’s ATM, Mr. Reichert 8 requested an accounting of his balance. This ATM inquiry was unsuccessful and did not 9 tell him the balance. Mr. Reichert was however charged a $1.50 “inquiry fee.” He then 10 attempted to retrieve $180.00 in funds, and the ATM screen said that there were 11 insufficient funds for the transaction. Mr. Reichert then used the same ATM to withdraw 12 $160. This transaction resulted in two $2.95 “issuer fees” and a $3.00 “acquirer 13 convenience fee,” that was likely charged by the local ATM provider—all within the 14 span of 58 seconds. 15 73. Knowing that he had more than $160 in cash at the time of his arrest, Mr. 16 Reichert then visited the credit union to inquire regarding his missing account balance 17 and to ask how to avoid fees. A credit union employee informed him that the credit 18 union likewise could not determine the account balance, and urged him to go online or 19 call the card issuer. 20 21 22 74. On November 8, 2016, a final $1.37 weekly maintenance fee was taken from Mr. Reichert’s account—the last few dollars and cents in the account. 75. Later, after calling Rapid Investments to inquire about his remaining 23 balance, Mr. Reichert received via email a printout of the various charges, and learned 24 that Defendants had taken $17.66 in fees in the two weeks after his release—exactly 10 25 percent of his cash, and after only approximately four hours in custody. 26 FIRST AMENDED COMPLAINT – 14 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 15 of 28 1 2 3 4 5 76. Had Mr. Reichert chosen not to use the AccessFreedom Card, and to close his account and receive a check, Defendants would have charged him $10.00 to do so. 77. Gary Moyer was incarcerated in Kitsap County jail. At the time of his incarceration, his cash was confiscated by Kitsap County officers. 78. Mr. Moyer was released in February of 2019. Upon his release, he was 6 provided with a AccessFreedom Card. The card was activated when given to him. 7 Pursuant to Kitsap County’s policy in February of 2019, Mr. Moyer was provided with 8 a copy of the Cardholder Terms and Conditions. 9 79. Mr. Moyer never applied for the AccessFreedom Card. 10 80. Mr. Moyer never agreed to receive the AccessFreedom Card instead of his 11 12 cash and never assented to the terms to any contract with Defendants. 81. Mr. Moyer had no choice but to accept the AccessFreedom Card instead of 13 his cash. Mr. Moyer could not meaningfully object to receiving the prepaid debit card. 14 Mr. Moyer’s receipt of his cash back in the form of the AccessFreedom Card was 15 completely and utterly involuntary. 16 17 82. Mr. Moyer was subject to and involuntarily paid numerous fees to Defendants, none of which he consented or agreed to. 18 19 20 21 V. CLASS CLAIMS 83. Defendants have engaged in the same conduct with respect to thousands of released inmates across the United States. 84. Plaintiffs bring this action on behalf of themselves, and all others similarly 22 situated pursuant to Fed. R. Civ. P. 23(a), 23(b)(2), and 23(b)(3) on behalf of the following 23 nationwide Class: All persons in the United States who, at any time since October 20, 24 2016, were: (1) taken into custody at a jail, correctional facility, detainment center, or any 25 other law enforcement facility, (2) entitled to the return of money either confiscated from 26 them or remaining in their inmate accounts when they were released from the facility, FIRST AMENDED COMPLAINT – 15 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 16 of 28 1 (3) issued a prepaid debit card from Keefe Commissary Network, LLC, Rapid 2 Investments, Inc. and/or Cache Valley Bank that was subject to fees, charges, and 3 restrictions and (4) not offered an alternative method for the return of their money. This 4 class shall be referred to as the “Nationwide Class.” 5 85. Additionally, Plaintiffs seek to represent the following Washington 6 Subclass: All persons who, at any time since October 20, 2013, were: (1) taken into 7 custody at a jail, correctional facility, detainment center, or any other law enforcement 8 facility located in the State of Washington, (2) entitled to the return of money either 9 confiscated from them or remaining in their inmate accounts when they were released 10 from the facility, (3) issued a prepaid debit card from Keefe Commissary Network, LLC, 11 Rapid Investments, Inc. and/or Cache Valley Bank that was subject to fees, charges, and 12 restrictions and (4) not offered an alternative method for the return of their money. This 13 class shall be referred to as the “Washington Subclass.” The Nationwide Class and the 14 Washington Subclass are collectively referred to herein as the “Class.” 15 16 86. The Nationwide Class and the Washington Subclass are both so numerous that joinder of all members is impracticable. Each class has more than 1,000 members. 17 87. Common questions of law and fact exist as to all members of the Class and 18 predominate over any questions solely affecting individual members of the Class. 19 Questions of law and fact common to the Class include but are not limited to: 20 A. Whether the AccessFreedom Cards that the Class received carried unlawful fees; 21 22 B. Whether the fees were a fair approximation of Defendants’ costs; 23 C. Whether the fees were unreasonable or unrelated to the administration of each user’s account; 24 25 26 D. Whether Defendants deprived Plaintiff and the Class of a right, privilege, or immunity protected by the Constitution or the laws of the United States; FIRST AMENDED COMPLAINT – 16 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 17 of 28 1 E. 1693, et seq.; 2 3 Whether Defendants violated the Electronic Fund Transfer Act, 15 U.S.C. F. Whether Defendants engaged in unfair or deceptive acts or practices in the 4 conduct of any trade or commerce and thus violated the Washington 5 Consumer Protection Act, RCW 19.86; 6 G. policies and practices; 7 8 Whether Defendants were unjustly enriched through their prepaid card H. Whether Defendants converted money belonging to the Class by taking unlawful fees; 9 10 I. Whether and what form(s) of relief should be afforded to the Class; and 11 J. Whether the Class has suffered damages as a result of Defendants’ actions, 12 and, if so, the measure and amount of such damages, including any 13 statutory damages. 14 88. Plaintiffs’ claims are typical of the claims of the other members of the Class 15 they seek to represent. Defendants’ practices have targeted and affected all members of 16 the Class in a similar manner, i.e., they have all sustained damages arising out of 17 Defendants’ practices. 18 89. Plaintiffs will fully and adequately protect the interests of all members of 19 the Class. Plaintiffs have retained counsel experienced in both complex class action and 20 consumer fraud litigation. Plaintiffs have no interests which are adverse to, or in conflict 21 with the interests of the other members of the Class. 22 90. A class action is superior to other available methods for the fair and 23 efficient adjudication of this controversy since joinder of all Class members is 24 impracticable. The prosecution of separate actions by individual members of the Class 25 would impose heavy burdens upon the courts, and would create a risk of inconsistent 26 or varying adjudications of the questions of law and fact common to the Class. A class FIRST AMENDED COMPLAINT – 17 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 18 of 28 1 action, on the other hand, would achieve substantial economies of time, effort, and 2 expense, and would assure uniformity of decision with respect to persons similarly 3 situated without sacrificing procedural fairness or bringing about other undesirable 4 results. 5 91. The interests of the members of the Class in individually controlling the 6 prosecution of separate actions are theoretical rather than practical. The Class has a high 7 degree of cohesion, and prosecution of the action through representatives would be 8 unobjectionable. The damages suffered by the individual Class members may be 9 relatively small. Therefore, the expense and burden of individual litigation make it 10 virtually impossible for Class members to redress the wrongs done to them. Plaintiffs 11 anticipate no difficulty in management of this action as a class action. 12 92. The parties opposing the Class have acted or refused to act on grounds 13 generally applicable to each member of the Class, thereby making appropriate final 14 injunctive or corresponding declaratory relief with respect to the Class as a whole. 15 VI. FIRST CAUSE OF ACTION 16 (Claim Pursuant to 42 U.S.C. § 1983 for Violation to the Fifth Amendment) 17 (Against all Defendants) 18 19 20 93. Plaintiffs re-allege and incorporate by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 94. The Takings Clause of the Fifth Amendment to the United States 21 Constitution states in relevant part that “private property [shall not] be taken for public 22 use, without just compensation.” 23 24 95. The Takings Clause is applicable to the states through the Fourteenth Amendment. 25 26 FIRST AMENDED COMPLAINT – 18 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 19 of 28 1 96. A governmental user fee that fails to bear a sufficient relationship to the 2 value received or fails to provide a fair approximation of the costs of the benefits 3 supplied—if any— constitutes a taking within the meaning of the Takings Clause. 4 97. Defendants engaged in state action under color of law, in that Plaintiffs’ 5 and the Washington Subclass’s unconstitutional deprivation of their property resulted 6 from a governmental policy. Defendants are persons for whom the State is responsible 7 in that: (a) Kitsap County, and other governmental entities that issue Defendants’ 8 prepaid debit release cards, bore an affirmative obligation upon release of Plaintiffs and 9 the Washington Subclass to return monies confiscated from them; (b) the State delegated 10 that function to Defendants and gave to Defendants Plaintiff’s confiscated money; and 11 (c) Defendants voluntarily assumed that obligation by contract. Defendants thereby 12 deprived Plaintiffs and the Washington Subclass of a right, privilege, or immunity 13 protected by the Constitution or the laws of the United States. 14 98. The State benefited from the actions of its delegee, as Defendants’ business 15 practices allow the State to administer a “cashless” inmate property release system and 16 save the costs associated with its own management of the inmate property release system 17 and issuance of checks. The State negotiated its delegation contract with Defendants, and 18 knowingly assented to Defendants’ fee structure as a means to transfer its costs onto 19 Plaintiffs and the Washington Subclass. 20 21 22 99. Plaintiffs and the Washington Subclass possessed a constitutionally protected interest in the monies Defendants took from them. 100. Defendants’ card user fees are excessive, unreasonable, unrelated to the 23 administration of the users’ accounts, and are imposed without regard to what, if any, 24 benefit the users received. 25 26 FIRST AMENDED COMPLAINT – 19 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 20 of 28 1 101. Defendants’ excessive and unreasonable card user fees should be declared 2 to constitute a taking of property in violation of the Fifth Amendment of the United 3 States Constitution. 4 5 6 7 102. Defendants should be ordered to compensate Plaintiffs and the Washington Subclass for the taking of property. 103. Plaintiffs and the Washington Subclass are entitled to their reasonable attorneys’ fees pursuant to 42 U.S.C. § 1988(b) (2000). 8 VII. SECOND CAUSE OF ACTION (Electronic Fund Transfer Act, 15 U.S.C. § 1693, et seq.) 9 (Against Defendants Rapid Financial and Cache Valley Bank) 10 11 12 13 104. Plaintiffs re-allege and incorporate by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 105. The primary objective of the Electronic Fund Transfer Act (“EFTA”) is to 14 protect consumer rights by providing a basic framework establishing the rights, 15 liabilities, and responsibilities of participants in the electronic fund and remittance 16 transfer systems. 17 106. Defendants Rapid Financial and/or Cache Valley Bank are financial 18 institutions as defined by 15 U.S.C. § 1693a(9), and 12 C.F.R. § 1005.2(a)(2)(i), because 19 they directly or indirectly hold accounts belonging to consumers and/or they issue an 20 access device to consumers. 21 107. 22 § 1693a(6). 23 108. 24 25 Plaintiffs and members of the Class are “consumers” under 15 U.S.C. Under the EFTA, an unsolicited card is permitted only if all of the following conditions are met: (1) such card, code, or other means of access is not validated; 26 FIRST AMENDED COMPLAINT – 20 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 21 of 28 1 2 3 4 5 (2) such distribution is accompanied by a complete disclosure, in accordance with section 1693c of this title, of the consumer’s rights and liabilities which will apply if such card, code, or other means of access is validated; (3) such distribution is accompanied by a clear explanation, accordance with regulation of the Bureau, that such card, code, or other means of access is not validated and how the consumer may dispose of such code, card, or other means of access if validation is not desired; and 6 7 8 9 10 11 (4) such card, code, or other means of access is validated only in response to a request or application from the consumer, upon verification of the consumer’s identity. 15 U.S.C. § 1693i(b). See also 12 C.F.R. § 1005.5(b) (same); 12 C.F.R. § 1005.2(a)(1) (“’Access device’ means a card…”). 109. This statutory and regulatory scheme protects consumers by mandating 12 that before a card is validated the consumer must receive a complete disclosure of the 13 rights and liabilities that “will apply if such card … is validated.” 14 110. “Validation” occurs when the card “may be used to initiate an electronic 15 fund transfer.” 15 U.S.C. § 1693i(c). In other words, a validated card is one that is already 16 activated. All of the cards issued to Plaintiffs and class members were already validated. 17 111. The EFTA regulates the precise form of assent necessary to make the terms 18 and conditions binding on the consumer. Pursuant to Section 4, assent to the issuance 19 of the card (and its corresponding terms and conditions) can only occur “in response to 20 a request or application from the consumer.” 15 U.S.C. § 1693i(b)(4). The consumer must 21 also be provided the terms and conditions before the card is validated so that the 22 consumer can decide whether to accept those terms. 15 U.S.C. § 1693i(b)(2). No other 23 form of assent is recognized by statute. 15 U.S.C. § 1693i(a), (b). As a result, a consumer 24 cannot be said to have “assented” to a contract for a card by simply taking it upon 25 release, or subsequently using the card. Under the EFTA, there is only one way that an 26 unsolicited card would be valid under federal law: FIRST AMENDED COMPLAINT – 21 [Case No. 3:17-cv-05848-RBL] a consumer must make an SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 22 of 28 1 affirmative “request or application” for activation. 15 U.S.C. § 1693i(b)(4). With respect 2 to Plaintiffs and all Class members, the cards were validated before they were even 3 provided to the them. No “request” or “application” preceded validation of any of the 4 cards given to Plaintiffs or Class members upon their release. 5 112. No contract or agreement was formed between Defendants and Plaintiffs 6 and Class members. Defendants had no authority or right to take money from Plaintiffs 7 and Class members in the form of fees. 8 9 10 11 113. Defendants’ Rapid Financial’s and/or Cache Valley Bank’s violations of the EFTA have caused and continue to cause Plaintiffs and the Class damages. 114. Plaintiffs and the Class are entitled to their actual and statutory damages, as well as reasonable attorneys’ fees and costs, pursuant to 15 U.S.C. § 1693m. 12 VIII. THIRD CAUSE OF ACTION 13 (Washington Consumer Protection Act, Wash. Rev. Code Ann. § 19.86, et seq.) 14 (Against all Defendants) 15 16 17 18 19 20 21 115. Plaintiffs re-allege and incorporate by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 116. Plaintiffs bring this action on behalf of himself and the Washington Subclass against all Defendants. 117. Defendants, Plaintiffs, and the Washington Subclass members are “persons” within the meaning of Wash. Rev. Code § 19.86.010(1). 118. Defendants are engaged in “trade” or “commerce” within the meaning of 22 Wash. Rev. Code § 19.86.010(2), because the unsolicited AccessFreedom cards are 23 intended to be used in commerce in Washington. 24 119. The Washington Consumer Protection Act (“Washington CPA”) makes 25 unlawful “[u]nfair methods of competition and unfair or deceptive acts or practices in 26 the conduct of any trade or commerce.” Wash. Rev. Code § 19.86.020. FIRST AMENDED COMPLAINT – 22 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 23 of 28 1 120. In the course of their business, Defendants, through their agents, 2 employees, and/or subsidiaries, violated the Washington CPA as detailed above. 3 Specifically, in distributing unsolicited prepaid debit cards, and then taking and keeping 4 Plaintiffs’ and the Washington Subclass members’ money in the form of exorbitant fees, 5 and in imposing fees for the return of Plaintiffs’ and the Washington Subclass members’ 6 money without disclosing that fees would be imposed, Defendants engaged in unfair 7 and/or deceptive acts or practices in violation of Wash. Rev. Code § 19.86.020. 8 9 10 11 121. Plaintiffs and the Washington Subclass members suffered ascertainable losses and actual damages in the loss of their property as a direct and proximate result of Defendants’ unfair and/or deceptive acts or practices. 122. Defendants’ violations present a continuing risk of injury to Plaintiffs and 12 the Washington Subclass members, as well as to the general public. Defendants’ 13 unlawful acts and practices complained of herein affect the public interest. 14 123. Pursuant to Wash. Rev. Code § 19.86.090, Plaintiffs and the Washington 15 Subclass members seek an order enjoining Defendants’ unfair and/or deceptive acts or 16 practices, and awarding damages, treble damages, attorney fees and costs and any other 17 just and proper relief available under the Washington CPA. 18 IX. FOURTH CAUSE OF ACTION 19 (Conversion) 20 (Against all Defendants) 21 22 23 124. Plaintiffs re-allege and incorporate by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 125. Kitsap County Jail, and other correctional facilities that issue Defendants’ 24 AccessFreedom Cards have taken money from Plaintiffs and other members of the 25 Washington Subclass to hold during their incarceration, acting in the capacity of their 26 representative. Upon their release, Kitsap County Jail and other correctional facilities FIRST AMENDED COMPLAINT – 23 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 24 of 28 1 were obligated to return the full amount of their money to them. Any purported 2 agreement to use the AccessFreedom Card to return that money, less fees charged by the 3 Defendants, lacks consideration and is unenforceable. 4 126. Conversion occurs when a person intentionally interferes with chattel 5 belonging to another, either by taking or unlawfully retaining it, thereby depriving the 6 rightful owner of possession. Money may be the subject of conversion if the Defendants 7 wrongfully received it. 8 127. Defendants, exercising their control over the funds in the AccessFreedom 9 Card accounts, have wrongfully collected fees from Plaintiffs and members of the 10 Washington Subclass, and have taken specific and readily identifiable funds from 11 Plaintiffs and the members of the Washington Subclass in payment of these fees. 12 128. Defendants, without proper authorization, assumed and exercised the 13 right of ownership over these funds, in hostility to the rights of Plaintiffs and the 14 Washington Subclass, without legal justification. 15 16 17 18 19 129. Defendants continue to retain these funds unlawfully and without the consent of Plaintiffs or the Washington Subclass. 130. Defendants intend to permanently deprive Plaintiffs and the Washington Subclass of these funds. 131. These funds are properly owned by Plaintiffs and the Washington 20 Subclass, not Keefe, Rapid Investments or Cache Valley Bank, which now claim that they 21 are entitled to their ownership, contrary to the rights of Plaintiffs and the Washington 22 Subclass. 23 24 132. Plaintiffs and the Washington Subclass are entitled to the immediate possession of these funds. 25 133. Defendants have wrongfully converted these specific and readily 26 identifiable funds. FIRST AMENDED COMPLAINT – 24 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 25 of 28 1 134. Defendants’ wrongful conduct is continuing. 2 135. As a direct and proximate result of Defendants’ wrongful conversion, 3 4 5 Plaintiffs and the Washington Subclass have suffered and continue to suffer damages. 136. Plaintiffs and the Washington Subclass are entitled to damages and prejudgment interest in an amount to be determined at trial. 6 X. FIFTH CAUSE OF ACTION 7 (Unjust Enrichment) 8 (Against all Defendants) 9 10 11 137. Plaintiffs re-allege and incorporate by reference all of the allegations of this Complaint with the same force and effect as if fully restated herein. 138. Defendants have been unjustly enriched by taking funds from the 12 AccessFreedom Card accounts under their control in the form of fees assessed upon 13 Plaintiffs and the Washington Subclass. 14 139. The circumstances are such that it would be unjust and inequitable for 15 Defendants to retain the benefit that they unjustly received from Plaintiffs and the 16 Washington Subclass members. 17 18 19 140. Plaintiffs and the Washington Subclass members have conferred benefits on Defendants, which Defendants have knowingly accepted and retained. 141. Plaintiffs and the Washington Subclass members have suffered and 20 continue to suffer actual damages as a result of Defendants’ unjust retention of proceeds 21 from their acts and practices alleged herein. 22 142. Plaintiffs and the Washington Subclass members seek to disgorge 23 Defendants’ unlawfully retained benefits resulting from their unlawful conduct, and 24 seek restitution for the benefit of Plaintiffs and the Washington Subclass. 25 26 143. Plaintiffs and the Washington Subclass members are entitled to the imposition of a constructive trust upon Defendants, such that their unjustly retained FIRST AMENDED COMPLAINT – 25 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 26 of 28 1 benefits are distributed equitably by the Court to and for the benefit of Plaintiffs and the 2 Washington Subclass members. 3 XI. DEMAND FOR JURY TRIAL 4 Plaintiffs respectfully requests jury trial of all claims that can be so tried. 5 XII. PRAYER FOR RELIEF 6 7 8 9 10 11 WHEREFORE, Plaintiffs, on behalf of themselves and on behalf of the Class, prays for the following relief: 1. An order certifying this case as a class action and appointing Plaintiffs and the undersigned counsel to represent the Class; 2. Declaration, judgment, and decree that Defendants Keefe, Rapid Investments and/or Cache Valley Bank’s conduct alleged herein: 12 a. Violates the Fifth Amendment to the United States Constitution; 13 b. Violates the Electronic Fund Transfer Act (as to Defendants Rapid Investments and Cache Valley Bank only); 14 15 c. Violates the Washington Consumer Protection Act; 16 d. Constitutes conversion; and 17 e. Constitutes unjust enrichment. 18 3. Damages to Plaintiffs and the Washington Subclass to the maximum extent 19 allowed under state and federal law; including ordering Defendants to pay actual and 20 statutory damages; 21 4. Costs and disbursements of the action; 22 5. Restitution and/or disgorgement of ill-gotten gains; 23 6. Pre- and post-judgment interest; and 24 7. Reasonable attorneys’ fees; and 25 8. Such other relief, in law and equity, as this Court may deem just and 26 proper. FIRST AMENDED COMPLAINT – 26 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 27 of 28 1 DATED: August 9, 2019. SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 2 3 s/ Chris R. Youtz Chris R. Youtz, WSBA #7786 Email: chris@sylaw.com 4 5 s/ Richard E. Spoonemore Richard E. Spoonemore, WSBA #21833 Email: rick@sylaw.com 6 7 8 s/ Eleanor Hamburger Eleanor Hamburger, WSBA #26478 Email: ele@sylaw.com 9 10 3101 Western Avenue, Suite 350 Seattle, WA 98121 Telephone: (206) 223-0303 Fax: (206) 223-0246 11 12 13 Attorneys for Plaintiffs 14 15 16 17 18 19 20 21 22 23 24 25 26 FIRST AMENDED COMPLAINT – 27 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246 Case 3:17-cv-05848-RBL Document 100 Filed 08/09/19 Page 28 of 28 CERTIFICATE OF SERVICE 1 2 3 4 5 I hereby certify that on August 9, 2019, I caused the foregoing to be electronically filed with the Clerk of the Court using the CM/ECF system, which will send notification of such filing to the following: • Sylvia Karen Bamberger kbamberger@bpmlaw.com, carkins@bpmlaw.com, lbrown@bpmlaw.com • Eleanor Hamburger ehamburger@sylaw.com, matt@sylaw.com, stacy@sylaw.com, theresa@sylaw.com • Emily J Harris eharris@corrcronin.com, sdamon@corrcronin.com, reception@corrcronin.com • Suzanne L Jones sjones@hinshawlaw.com, mharo@hinshawlaw.com • Eric A Lindberg elindberg@corrcronin.com, mdawson@corrcronin.com • Daniel Marshall dmarshall@hrdc-law.org, kmoses@humanrightsdefensecenter.org, tlivingston@humanrightsdefensecenter.org • Masimba Mutamba mmutamba@hrdc-law.org, kmoses@hrdc-law.org • Sabarish Neelakanta sneelakanta@hrdc-law.org • Russell S Ponessa rponessa@hinshawlaw.com • Richard E Spoonemore rspoonemore@sylaw.com, matt@sylaw.com, rspoonemore@hotmail.com, theresa@sylaw.com, stacy@sylaw.com • George F Verschelden george.verschelden@stinson.com, linda.stephen@stinson.com • Chris Robert Youtz chris@sylaw.com, matt@sylaw.com, theresa@sylaw.com, stacy@sylaw.com 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 DATED: August 9, 2019, at Seattle, Washington. 23 s/ Richard E. Spoonemore Richard E. Spoonemore, WSBA #21833 24 25 26 FIRST AMENDED COMPLAINT – 28 [Case No. 3:17-cv-05848-RBL] SIRIANNI YOUTZ SPOONEMORE HAMBURGER PLLC 3101 WESTERN AVENUE, SUITE 350 SEATTLE, WASHINGTON 98121 TEL. (206) 223-0303 FAX (206) 223-0246