Corrections Education in Utah 2012

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

Corrections Education in Utah: Measuring Return on Investment

Richard Fowlesi

Department of Economics & Graduate Program in Statistics

University of Utah

October 2012

Executive Summary

Utah's public expenditure on corrections education is highly taxpayer efficient. This study finds:

•

Spending on corrections education programs in prison is taxpayer efficient in terms of

reduced recidivism costs associated with police, courts, corrections, and tangible costs

of crime. The benefit-cost ratio is estimated at 6.03.

•

Corrections education provides the basis for inmate integration into the workplace. The

estimated benefit-cost ratio of corrections education coupled with post release

employment is 13.66.

•

The Utah taxpayer breakeven cost of corrections education to cover recidivism costs of

police, courts, corrections, and tangible crime costs is $1,800 per client. Utah's

expenditure of $512 is substantially below this.

•

Education expenditures are inexpensive relative to other prison programming options

and thus result in large effects per dollar spent.;;

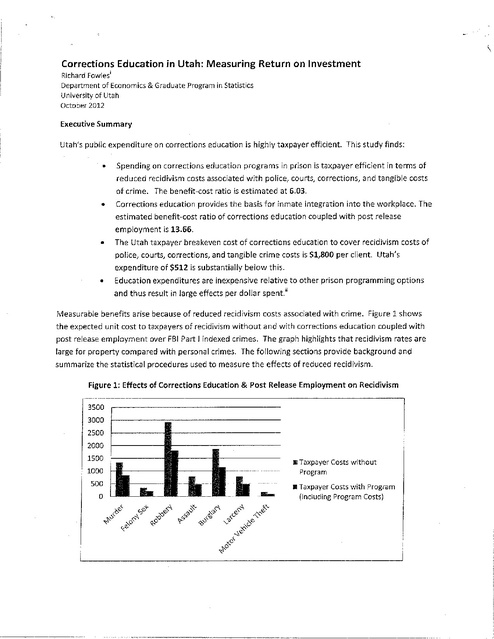

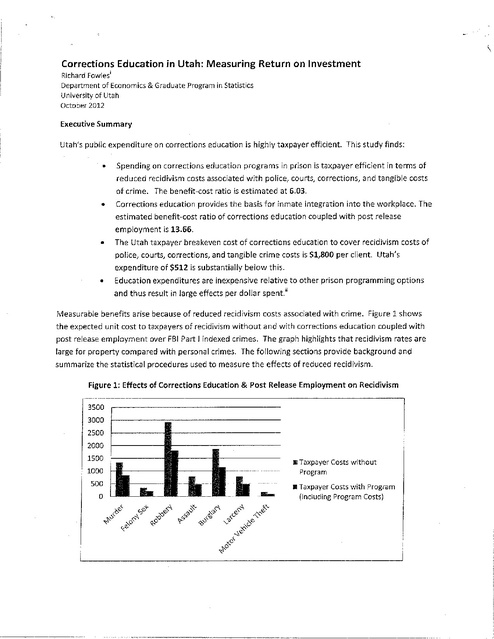

Measurable benefits arise because of reduced recidivism costs associated with crime. Figure 1 shows

the expected unit cost to taxpayers of recidivism without and with corrections education coupled with

post release employment over FBI Part I indexed crimes. The graph highlights that recidivism rates are

large for property compared with personal crimes. The following sections provide background and

summarize the statistical procedures used to measure the effects of reduced recidivism.

Figure 1: Effects of Corrections Education & Post Release Employment on Recidivism

3500

3000

2500

2000

1500

1000

500

0

ll Taxpayer

Costs without

Program

•Taxpayer Costs with Program

(Including Program Costs)

Background

In 2010, Utah taxpayers spent over $1.3 billion relating to criminal justice in areas of police, courts, and

corrections.'" This $470 per capita expense is an important and necessary component of public safety

cost and is below what other states spend on a per capita level.'' Nonetheless, with shrinking budgets in

the face of slow economic growth, Utah policy makers must be increasingly diligent when making

decisions regarding how taxpayers' monies are spent to enhance public safety and reduce crime. This

report uses a new method that provides policy makers with an instrument to better assess the economic

efficacy of crime-reducing programs, particularly on those designed to reduce recidivism via corrections

education. It is based on two economic metrics: a taxpayer benefit-cost ratio and a direct measure of

the cost per unit of recidivism reduction. Adept decisions by policy makers require that benefit and risk

simultaneously be taken into consideration when choosing among recidivism reduction programs. In

Utah, as in other states, spending on corrections education ranks among the most taxpayer efficient

legislative options.

Methodology

Comparing benefits and costs is a fundamental way that consumers seek to find good values in the

market. This method also forms the basis for optimal decision making by firms' managers seeking to

increase profits. Benefit-cost analyses are now being applied to non-market decision making, especially

by legislative decision makers who have to make difficult budget decisions faced with tightened

available monies.

A cost-benefit analysis (CBA) is an economic tool that evaluates the cost and benefits that are associated

with investing in various programs and projects. With respect to the criminal justice system, a CBA can

provide policy makers with a metric that is aligned with the expected return on tax dollars spent when

investing in programs that aim to lessen criminal activity. Because reduction in criminal activity is not

market priced, estimates of benefits arising from lower crime are required. The basis for a CBA involves

the statistical estimation of the unit, or marginal, cost and benefits of crime. The unit benefit is the

expected reduction in recidivism as a direct result of an inmate participating in a program such as

corrections education. This is then translated into monetary units upon which comparisons can be

made.

The unit cost of crime pertains to both taxpayer and victim costs. Taxpayer costs are tangible costs that

arise from the criminal justice system. These costs include the cost of police, courts, prosecutors, and

corrections. Victim costs can be both tangible and intangible. Examples of tangible victim costs are the

direct medical expenses and damage to property subject to victims of crime. Intangible victim costs

include pain, suffering, and an overall reduction in a person's quality of life. These indirect expenditures

are challenging to measure and remain a contentious topic. For simplicity, this report focuses attention

on direct taxpayer benefits and costs and considers only tangible victim costs. This choice is not meant

to downplay intangible victim costs, but estimates of these vary so widely that policy can be obscured.'

Data & Estimation

The econometric basis for this report relies on Utah's 2012 Benefit-Cost model developed by the Utah

Commission on Criminal and Juvenile Justice (CCJJ). Taxpayer costs are associated with police, courts,

and corrections. The sources of these data are described below.

Detailed cost data for police and sheriffs were obtained from the Office of the Utah State Auditor. Total

operating expenses related to county sheriff and local police departments were extracted from Utah's

29 counties and 79 of its municipalities' annual budgets between 2005 and 2010."; These expenditures

were put into constant 2010 dollars and aligned with arrest data obtained from the Bureau of Criminal

Investigation (BCI). A large sample was used in the estimation of marginal cost (n = 86, N = 516).

In the state of Utah, felony crimes are primarily prosecuted by county attorneys in the district courts.

With respect to the unit cost of courts, the number of weighted minutes required for each case type and

the total case filing count were obtained from the Administrative Office of the Courts for FY 2011. These

minutes are, if effect, true marginal costs but are dimensioned in time magnitudes and not in monetary

units. However, budget information allowed for the calculation of dollars per minute estimates.';; These

dollars per minute estimates were then multiplied by the number of weighted minutes needed for two

levels of felony crimes,';;; which directly gave us the marginal cost for courts.

The marginal cost of prosecution was estimated using a similar technique as for sheriff and local police

departments. Total annual operating budgets for Utah's 29 county prosecutors;' were obtained from

the Office of the Utah State Auditor between 2005 and 2010.

This study is limited to the cost of adult incarceration. The average annual cost of a prisoner was

obtained from the Utah Department of Corrections' and was used as a constant across all Part 1 Crimes.

The average annual cost per inmate was then multiplied with the probability of each indexed crime

leading to incarceration to derive the final unit cost estimate with respect to corrections. Table 1

summarizes the unit taxpayer costs associated with police, courts, and corrections for part 1 crime.

Table 1

Utah Unit Taxpayer & Victim Costs ($)

Taxpayer

Crime Type

tF::\_::r;}}g~;r~:-~;4~;~&~Mtfii(;t'~;;;t<~29, 791

18,776

Aggravated Assault

.·;~;t;~iji~9/J,Silc~s;/&?i

.?;ci± E'1 ~0?.~i§.?4~t7i.6ir·.~Yd

Larceny/Theft

'illi'iiit,il'r'Xliih.idei±Hiift:'.).> · •

9,671

•··;;;z,fi{3~•'

,•;•y/·,·

The marginal benefits of programs are translated into percentage reductions in recidivism. These

reductions are called the effect sizes. They can be estimated individually, or based on aggregation of

national estimates based on an assortment of studies. Because studies vary widely in terms of rigor, this

report relies on a meta-analysis of prison education that discounts results of observational studies

relative to studies that utilize an experimental or quasi-experimental design in measuring the effect size.

This report utilizes findings from Wilson, et al. (2000) which well aligns with other meta-analytic studies

and individual Utah studies.';

Results

Based on the 2012 Utah Benefit Cost Model and data provided by the Utah State Office of Education and

the Department of Corrections, the raw taxpayer benefit cost ratio is estimated at 2.9 and at 6.03 when

tangible victim costs are accounted for. The base recidivism rate is 50% for a 36-month return to

prison.';; The point estimated effect size attributed to corrections education is a 9 percentage point

decrease in recidivism, or an 18 percent reduction in recidivism. At a program cost of $512 per

offender, the expected reduction in direct recidivism costs (police, courts, and corrections) is $1,484 per

offender.';;; At the margin, Utah taxpayers directly realize nearly a $3.00 return on investment in

corrections education on police, courts, and corrections. This return on investment increases to over

$6.00 when tangible victim costs are included. These results are presented in the first part of Table 2.

A primary benefit of corrections education is that offenders can integrate into the workforce. The

effects of employment after release lower the expected recidivism rate to 31% (or a percentage

reduction in recidivism of 38%). As is shown in the second part ofTable 2, post release employment

doubles the efficiency ratio of corrections education.

Table 2

Benefit Cost Estimates

Utah Corrections Education

Base Recidivism

50%

Effect (Reduction in Recidivism)

18%

Utah Taxpayer+ Tangible Victim Efficiency Ratio

6.03

Program Recidivism With Post Release Employment

31%

Utah Taxpayer Efficiency Ratio with Employment

6.04

·... ,qtilh:r~kll"~~eR+fa'~.~limt~}yiriti.frl\~ttrc:i~hsxIB~~1#;W\~b·,~.l!i.e1.9¥:fue\if:'•·· ,, ·

c1'3xfi6

Conclusion

The efficiency of expenditures on corrections education is widely recognized.';' Education programs

provide basic tools that allow inmates to re-socialize while in prison and set a base for re-entry to labor

market upon release. Generally, prison inmates are less well educated than competing workers and

have a substantially higher labor market barrier to employment after release than other job candidates.

Providing basic education demonstrably lowers recidivism and enables parolees to participate in postrelease jobs programs to further enhance taxpayer benefits. Among policy options that legislators have

in considering recidivism reduction programs, education ranks among the most taxpayer efficient,

largely because educational programs are substantially lower than other programs and far lower than

the costs associated with incarceration.

Notes

; Email: richard.fowles@economics.utah.edu, Phone: (801) 581-4577, Fax: (801) 585-5649.

n See, for example, Aos, S. et al., "Return on Investment: Evidence-Based Options to Improve Statewide

Outcomes," Washington State Institute for Public Policy, July 2011.

rn Cost estimate includes expenditures on the state, county, and municipality level. State expenditures were

obtained from the Governor's Office of Planning & Budget and include total operating budgets for FY 2010 for

public safety, adult corrections, juvenile justice, board of pardons, and the attorney general's office. Case load

statistics for district courts were obtained for FY 2008 and allowed us to focus on the criminal and traffic (36

percent) portion of expenditures with respect to courts. All county and municipality expenditures were obtained

from the Office of the Utah State Auditor. County level expenditures include total operating budgets for sheriff

departments, justice courts, attorneys, and jails. Municipality level expenditures include total operating budgets

for local police departments, justice courts, and attorneys for 79 of Utah's municipalities. Some civil expenditures

are included for attorneys on the state, county, and municipality level and for courts on the county and

municipality level.

;, Bureau of Justice Statistics, December, 2011 Bureau of Justice Statistics (2011) [online]

[http://bjs.ojp.usdoj.gov/index.cfm?ty=pbdetail&iid=2192]. In calculating per capita justice expenditures for the

United States, BJS includes both criminal and civil police and judicial expenditures. For this study, we consider

mainly criminal expenditures.

'Tangible and intangible victim costs are well developed in Mccollister, K.E., et al., "The Cost of Crime to Society:

New Crime-Specific Estimates for Policy and Program Evaluation," Drug and Alcohol Dependence, 108(1), 98-109,

2010.

''The relatively few missing data points were imputed using standard techniques including linear interpolation and

averaging.

,;; Total operating budgets for the district courts for FY 2011 were obtained from the Governor's Office of Planning

& Budget.

,;;;Three levels of felony crimes (felony 1", felony 2"', and felony capital) were considered. Capital felony was

excluded since it represented less than .07 percent of these three levels of felony crimes. Hence, this study

reflects the modal rather than the extreme with respect to murder. Felony 1" and felony 2"' were translated to

violent and property crimes. Here we assume that felony 1" and felony 2"' is correlated with the UCR's definition

of violent and property crimes. In the future, it would be efficacious to obtain information that breaks this down

by offense type.

;, Because of data inconsistencies, the operating budgets for public defenders were not included.

'Utah Department of Corrections, Division of Institutional Operations, Cost Per Day Report, FY 2009.

Wilson, D.B. 1 et al., 11 A Meta-Analysis of Corrections-Based Education, Vocation, and Work Programs for Adult

Offenders," Journal of Research in Crime and Delinquency, 37, 347-368, 2000.

xi

'''The benefit-cost model assumes a total 36-month recidivism rate for any return at 65% but is recalibrated to

50% for this report. This slightly decreases the estimated benefit-cost ratio, thus the reported estimates are

somewhat conservative.

xiii Range estimates at 95 percent confidence limits show positive taxpayer effects with a 3 percentage point

decrease in recidivism. Detailed estimates are available upon request.

See, for example, Sedgely, et al. "Prison 1 s Dilemma: Do Education and Jobs Programmes Affect Recidivism?"

Economica, 77, 497-517, 2010.

xiv