Ncsl Sex Offender Registration Non-compliance State Penalties

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

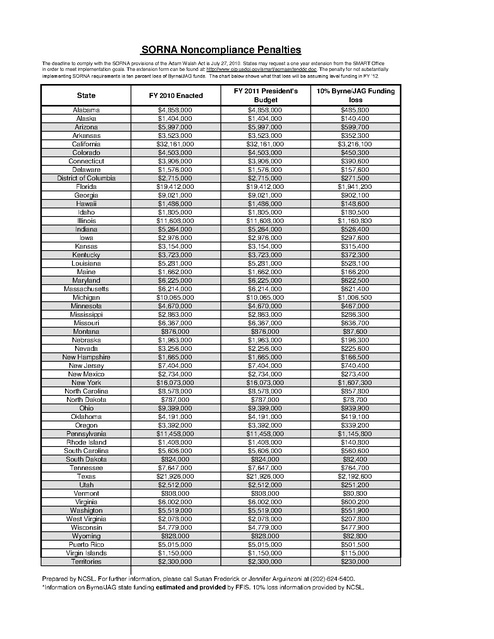

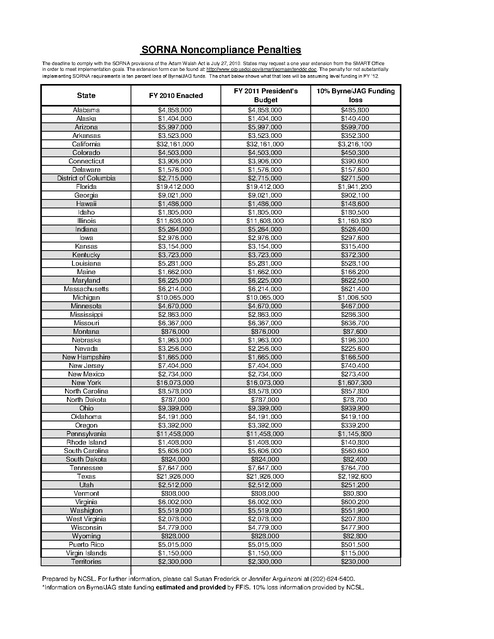

SORNA Noncompliance Penalties The deadline to comply with the SORNA provisions of the Adam Walsh Act is July 27, 2010. States may request a one year extension from the SMART Office in order to meet implementation goals. The extension form can be found at: http://www.ojp.usdoj.gov/smart/sornaextenddc.doc. The penalty for not substantially implementing SORNA requirements is ten percent loss of Byrne/JAG funds. The chart below shows what that loss will be assuming level funding in FY ’12. State FY 2010 Enacted Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washigton West Virginia Wisconsin Wyoming Puerto Rico Virgin Islands Territories $4,858,000 $1,404,000 $5,997,000 $3,523,000 $32,161,000 $4,503,000 $3,906,000 $1,576,000 $2,715,000 $19,412,000 $9,021,000 $1,486,000 $1,805,000 $11,608,000 $5,264,000 $2,976,000 $3,154,000 $3,723,000 $5,281,000 $1,662,000 $6,225,000 $6,214,000 $10,065,000 $4,670,000 $2,863,000 $6,367,000 $876,000 $1,963,000 $3,256,000 $1,665,000 $7,404,000 $2,734,000 $16,073,000 $8,578,000 $787,000 $9,399,000 $4,191,000 $3,392,000 $11,458,000 $1,408,000 $5,606,000 $824,000 $7,647,000 $21,926,000 $2,512,000 $808,000 $6,002,000 $5,519,000 $2,078,000 $4,779,000 $828,000 $5,015,000 $1,150,000 $2,300,000 FY 2011 President's Budget $4,858,000 $1,404,000 $5,997,000 $3,523,000 $32,161,000 $4,503,000 $3,906,000 $1,576,000 $2,715,000 $19,412,000 $9,021,000 $1,486,000 $1,805,000 $11,608,000 $5,264,000 $2,976,000 $3,154,000 $3,723,000 $5,281,000 $1,662,000 $6,225,000 $6,214,000 $10,065,000 $4,670,000 $2,863,000 $6,367,000 $876,000 $1,963,000 $2,256,000 $1,665,000 $7,404,000 $2,734,000 $16,073,000 $8,578,000 $787,000 $9,399,000 $4,191,000 $3,392,000 $11,458,000 $1,408,000 $5,606,000 $824,000 $7,647,000 $21,926,000 $2,512,000 $808,000 $6,002,000 $5,519,000 $2,078,000 $4,779,000 $828,000 $5,015,000 $1,150,000 $2,300,000 10% Byrne/JAG Funding loss $485,800 $140,400 $599,700 $352,300 $3,216,100 $450,300 $390,600 $157,600 $271,500 $1,941,200 $902,100 $148,600 $180,500 $1,160,800 $526,400 $297,600 $315,400 $372,300 $528,100 $166,200 $622,500 $621,400 $1,006,500 $467,000 $286,300 $636,700 $87,600 $196,300 $225,600 $166,500 $740,400 $273,400 $1,607,300 $857,800 $78,700 $939,900 $419,100 $339,200 $1,145,800 $140,800 $560,600 $82,400 $764,700 $2,192,600 $251,200 $80,800 $600,200 $551,900 $207,800 $477,900 $82,800 $501,500 $115,000 $230,000 Prepared by NCSL. For further information, please call Susan Frederick or Jennifer Arguinzoni at (202)-624-5400. *Information on Byrne/JAG state funding estimated and provided by FFIS. 10% loss information provided by NCSL.