Pay to Play? Campaign Finance and the Incentive Gap in the Sixth Amendment's Right to Counsel, Duke Law Journal, 2020

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

70 DUKE L.J. __ (2020) (forthcoming)

Pay to Play? Campaign Finance and the Incentive Gap

in the Sixth Amendment’s Right to Counsel

Neel U. Sukhatme* and Jay Jenkins**

Abstract

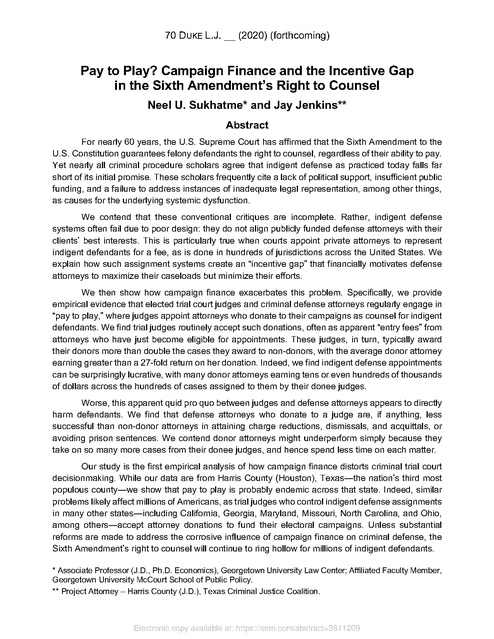

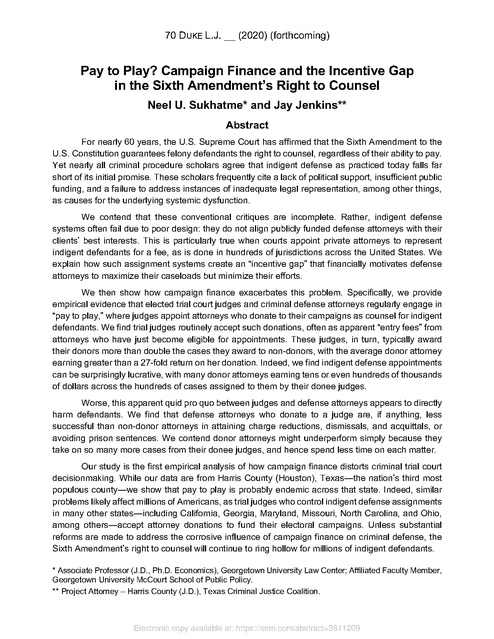

For nearly 60 years, the U.S. Supreme Court has affirmed that the Sixth Amendment to the

U.S. Constitution guarantees felony defendants the right to counsel, regardless of their ability to pay.

Yet nearly all criminal procedure scholars agree that indigent defense as practiced today falls far

short of its initial promise. These scholars frequently cite a lack of political support, insufficient public

funding, and a failure to address instances of inadequate legal representation, among other things,

as causes for the underlying systemic dysfunction.

We contend that these conventional critiques are incomplete. Rather, indigent defense

systems often fail due to poor design: they do not align publicly funded defense attorneys with their

clients’ best interests. This is particularly true when courts appoint private attorneys to represent

indigent defendants for a fee, as is done in hundreds of jurisdictions across the United States. We

explain how such assignment systems create an “incentive gap” that financially motivates defense

attorneys to maximize their caseloads but minimize their efforts.

We then show how campaign finance exacerbates this problem. Specifically, we provide

empirical evidence that elected trial court judges and criminal defense attorneys regularly engage in

“pay to play,” where judges appoint attorneys who donate to their campaigns as counsel for indigent

defendants. We find trial judges routinely accept such donations, often as apparent “entry fees” from

attorneys who have just become eligible for appointments. These judges, in turn, typically award

their donors more than double the cases they award to non-donors, with the average donor attorney

earning greater than a 27-fold return on her donation. Indeed, we find indigent defense appointments

can be surprisingly lucrative, with many donor attorneys earning tens or even hundreds of thousands

of dollars across the hundreds of cases assigned to them by their donee judges.

Worse, this apparent quid pro quo between judges and defense attorneys appears to directly

harm defendants. We find that defense attorneys who donate to a judge are, if anything, less

successful than non-donor attorneys in attaining charge reductions, dismissals, and acquittals, or

avoiding prison sentences. We contend donor attorneys might underperform simply because they

take on so many more cases from their donee judges, and hence spend less time on each matter.

Our study is the first empirical analysis of how campaign finance distorts criminal trial court

decisionmaking. While our data are from Harris County (Houston), Texas—the nation’s third most

populous county—we show that pay to play is probably endemic across that state. Indeed, similar

problems likely affect millions of Americans, as trial judges who control indigent defense assignments

in many other states—including California, Georgia, Maryland, Missouri, North Carolina, and Ohio,

among others—accept attorney donations to fund their electoral campaigns. Unless substantial

reforms are made to address the corrosive influence of campaign finance on criminal defense, the

Sixth Amendment’s right to counsel will continue to ring hollow for millions of indigent defendants.

* Associate Professor (J.D., Ph.D. Economics), Georgetown University Law Center; Affiliated Faculty Member,

Georgetown University McCourt School of Public Policy.

** Project Attorney – Harris County (J.D.), Texas Criminal Justice Coalition.

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

Introduction

1

The Promise and Failure of Gideon: A Brief History of the Right to Counsel

Under the Sixth Amendment

5

The Incentive Gap in the Right to Counsel

Background on Indigent Defense Systems

Assigned Counsel

Contract Attorneys

Public Defenders

Different Systems, Different Incentives

Caseload Incentives for Assigned Counsel and Contract Attorneys

Caseload Incentives for Public Defenders

Private Attorneys

The Incentive Gap Magnified: Campaign Finance and Pay to Play

Attorney Donations and Indigent Defense in Texas

Attorney Donations in Trial Courts Elsewhere

11

11

12

13

13

14

14

17

18

19

19

22

The Incentive Gap and Pay to Play: An Empirical Analysis of Campaign Finance and

Indigent Defense in Harris County, Texas

Background on Harris County

Courts and Judicial Elections

Indigent Defense

Construction of the Data

Summary Statistics

Cases and Contributions

Donations, Appointments, and Revenues

Pay to Play: Regressions and Graphical Evidence

Donations, Appointments, and Revenues

Comparisons Within the Donor Class

Donation Timing and “Entry Fees”

Case Outcomes

26

26

26

27

29

32

32

35

37

37

39

41

42

The Pervasiveness of the Incentive Gap: Campaign Finance and Other Reforms

45

Conclusion

49

Appendix

50

The authors thank participants at the Georgetown Law Summer and Fall Faculty Workshops and The

University of Texas Law and Economics Workshop; Jason Tashea and Keith Porcaro for connecting the

authors; the Texas Indigent Defense Commission; and Gregg Bloche, Alex Bunin, Jens Dammann, David

Hyman, Greg Klass, David Luban, Paul Ohm, David Schwartz, Mike Seidman, Gerry Spann, David Super,

Josh Teitelbaum, and Abe Wickelgren for helpful comments. We are grateful to Kyle Rozema for kindly sharing

Texas bar data. We especially thank Arturo Romero Yáñez for superb research assistance on this project. Any

errors are the authors’ own.

2

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

I.

Introduction

Were they alive today, Johnny Ray Johnson and Keith Steven Thurmond would be experts

on what happens when indigent defendants are not assigned competent counsel. Both were inmates

on death row in Harris County, Texas. In 2004, Mr. Johnson’s appointed attorney, Jerome Godinich,

missed the deadline to file a petition for federal habeas corpus relief. Mr. Godinich claimed a

malfunctioning filing machine failed to date-stamp the petition, which he filed after the court had

already closed on the deadline date. His client eventually lost on appeal and was executed.1

Months after the first missed deadline, Mr. Godinich missed the same deadline in Mr.

Thurmond’s case. His excuse? The same malfunctioning filing machine. The delay foreclosed a

petition from Mr. Thurmond, who was also eventually put to death.2

Sadly, cases like these are not so rare. Although many indigent defense counsel perform

admirably for their clients, others have fallen asleep during a client’s capital murder trial,3 neglected

to address an inflammatory opening by a prosecutor,4 or allowed their client to remain locked up in

pre-trial detention for 17 months before investigating facts in a drug possession case in which no

drugs were ever found.5 There is, unfortunately, no shortage of such horror stories.

More prosaically, public defenders and assigned defense counsel often fail their clients

simply because they are spread too thin across too many cases. Many of these attorneys handle

hundreds of matters at the same time,6 practically precluding them from conducting a focused

investigation on any one case or providing truly individualized counsel to any one defendant. So it is

no surprise that the vast majority of indigent defendants simply do the most expeditious thing and

quickly plead guilty to whatever deal they are offered—often after being encouraged to do so by their

own lawyer.

This dynamic has led most criminal procedure scholars and many practicing attorneys to

assail the state of indigent defense in America. To illustrate, the Yale Law Journal held a symposium

in 2013 to commemorate the 50th anniversary of Gideon v. Wainwright,7 the landmark decision that

established a right to counsel under the Sixth Amendment to the U.S. Constitution for all state felony

1

See Lise Olsen, Slow Paperwork in Death Row Cases Ends Final Appeals for 9, Hᴏᴜs. Cʜʀᴏɴ. (Mar. 21,

2009).

2

See Thurmond v. Thaler, 2011 U.S. App. LEXIS 1608 (2011).

3

See Carol S. Steiker, Gideon at Fifty: A Problem of Political Will, 122 Yᴀʟᴇ L.J. 2694 (2012) (citing Henry

Weinstein, A Sleeping Lawyer and a Ticket to Death Row, L.A. Tɪᴍᴇs, July 15, 2000, available at

http://articles.latimes.com/2000/jul/15/news/mn-53250).

4

See id. (describing how an indigent defense attorney said nothing in response to a prosecutor claiming the

defendant had bitten a child in a rape and murder case and could be identified through bite marks; the

defendant was exonerated 17 years later).

5

See Lise Olsen, Hundreds of Indigent Inmates Jailed for Months Pretrial, Hᴏᴜs. Cʜʀᴏɴ. (Oct. 3, 2009), at

https://www.chron.com/news/houston-texas/article/Hundreds-of-indigent-inmates-jailed-for-months1566415.php (noting failure of assigned counsel to investigate on behalf of defendant charged with possession

of cocaine even though no drugs were found on him).

6

See, e.g., Steiker, supra note __, at 2696 (noting, e.g., “In Miami-Dade County, Florida, the average felony

caseload per lawyer has reached five hundred in recent years due to budget cuts.”).

7

Gideon v. Wainwright, 372 U.S. 335 (1963). Indigent capital defendants have had the right to counsel since

the Supreme Court’s decision in Powell v. Alabama, 287 U.S. 68, 68-69.

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

defendants. The occasion, however, turned out to be more lamentation than celebration, as legal

scholars and practitioners pointed out again8 and again9 and again10 the persistent failures of indigent

defense systems across the country.

Most of these critiques rely in some part on a standard narrative that centers on money and

power.11 Critics recognize that while Gideon required states to provide counsel for indigent

defendants, this mandate was unfunded.12 Political actors, in turn, lacked the will to provide the

resources necessary to make a poor defendant’s right to counsel more than a symbolic gesture.13

Combined with a substantial increase in prosecutorial power, as well as the Supreme Court’s

reticence to put substantial teeth into the requirement that appointed counsel actually be effective,14

the manifest failures of indigent defense in America are hardly surprising.

Certainly this standard narrative contains a good bit of truth. But, as we show here, it is

incomplete, particularly in the context of assigned counsel systems, in which courts assign private

attorneys to represent defendants for a fee. Such systems, which are used in hundreds of

jurisdictions across the country, are undoubtedly underfunded on the whole. But that does not mean

they are not highly profitable for some. As we show, many defense attorneys make tens or even

hundreds of thousands of dollars in a given year across assignments from a single judge.

8

See, e.g., Roger A. Fairfax, Jr., Searching for Solutions to the Indigent Defense Crisis in the Broader Criminal

Justice Reform Agenda, 122 Yᴀʟᴇ L.J. 2150 (2012) (“[F]ifty years after Gideon was decided, there is nearuniversal acceptance of the notion that our system of indigent defense is broken.”); Pamela R. Metzger, Fear

of Adversariness: Using Gideon To Restrict Defendants’ Invocation of Adversary Procedures, 122 Yᴀʟᴇ L.J.

2550 (20120) (arguing “the Supreme Court has used Gideon to decrease the protection of Sixth Amendment

rights that constitute the core structures of the American adjudicatory process.”)

9

See Stephen B. Bright & Sia M. Sanneh, Fifty Years of Defiance and Resistance After Gideon v. Wainwright,

122 Yᴀʟᴇ L.J. 2150 (2012); see also Victoria Nourse, Gideon’s Muted Trumpet, 58 Mᴅ. L. Rᴇᴠ. 1417 (“Once

the darling of the legal academy, criminal procedure has fallen into disrepute.”); see also id. at 1431 (“The

importance of the lawyer . . . is not someone to try a case (most cases are never tried), but someone to stand

with the individual citizen unaligned to the forces that laid him low and resist claims of the natural and inevitable

superiority of government.”).

10

See Gabriel J. Chin, Race and the Disappointing Right to Counsel, 122 Yᴀʟᴇ L.J. 2236 (2012).

11

By contrast, a few critiques have cut much deeper. In particular, Paul Butler argues Gideon itself was

misguided and has led to more harm than good. He contends that by coating the trial process with a false

veneer of objectivity and fairness, the right to counsel might actually obfuscate the system’s true goal of

subjugating poor and black people. See Paul D. Butler, Poor People Lose: Gideon and the Critique of Rights,

122 Yᴀʟᴇ L.J. 2176 (2012). As Professor Butler notes, similar arguments have also been made in other areas

of criminal procedure. See, e.g., Louis Michael Seidman, Brown and Miranda, 80 Calif. L. Rev. 673, 719 (1992)

(arguing that Brown v. Board of Education, 347 U.S. 483 (1954) and Miranda v. Arizona, 384 U.S. 436 (1966)

“served to stabilize and legitimate the status quo by creating the illusion of closure and cohesion”); see also

William J. Stuntz, Tʜᴇ Cᴏʟʟᴀᴘsᴇ ᴏғ Aᴍᴇʀɪᴄᴀɴ Cʀɪᴍɪɴᴀʟ Jᴜsᴛɪᴄᴇ 3 (2011) (noting that accused persons have

fared worse as rights have expanded).

12

See, e.g., Erwin Chemerinsky, Lessons from Gideon, 122 Yᴀʟᴇ L.J. 2676, 2680 (2012) ("The Court imposed

an unfunded mandate on state governments without any enforcement mechanism, and the Court then

undermined the one remedy available to the judiciary, the ability to find ineffective assistance of counsel."); M.

Clara Garcia Hernandez & Carole J. Powell, Valuing Gideon’s Gold: How Much Justice Can We Afford?, 122

Yᴀʟᴇ L.J. 2358 (2012).

13

See Carol S. Steiker, Gideon at Fifty: A Problem of Political Will, 122 Yᴀʟᴇ L.J. 2694 (2012).

14

See infra notes __ and accompanying text (discussing Strickland v. Washington, 466 U.S. 668 (1984) and

succeeding cases).

2

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

Moreover, these attorneys often continue to receive such assignments even after they have

been revealed to be woefully incompetent. For example, in the years after Mr. Johnson and Mr.

Thurmond were executed, Mr. Godinich was appointed as counsel in state court for hundreds of

other felony defendants, continuing to amass a record of inadequate representation during this

time.15 Judges could have appointed other lawyers to these cases. Why did they continue to appoint

the same underperforming attorneys?

The proximate cause,16 we argue, may lie in campaign finance. Mr. Godinich was assigned

the majority of his felony cases from one trial court judge, Jim Wallace. Mr. Godinich was also a

significant donor to Judge Wallace. Between 2005 and 2014, Mr. Godinich donated on seven

occasions a total of $9,000 to Judge Wallace’s electoral campaigns. Between 2004 and 2018, Judge

Wallace appointed Mr. Godinich to 1,974 cases, including 5 capital cases. And since 2014, Mr.

Godinich has earned at least $872,642.50 from cases before Judge Wallace. Clearly, some indigent

defense attorneys are not just scraping by.

While Mr. Godinich is an outlier, the link between campaign finance and indigent defense

extends far beyond him. In this Article, we expose this hidden connection. In particular, we present

empirical evidence of “pay to play,” where defense attorneys donate to elected judges to obtain or

maintain access to indigent defense cases.

We accomplish this by creating the first large-scale database that links trial court campaign

contributions with multiple criminal court datasets. Specifically, our data comprise the universe of

290,633 felony cases from January 2005 through May 2018 where defense counsel were assigned

and ascertainable in Harris County, the nation’s third most populous county and the home of the City

of Houston. While a few recent papers have looked at how campaign donations might influence

elected state Supreme Court justices,17 ours is the first to explore how campaign finance might affect

trial court decision-making and criminal case outcomes.

15

See Casey Tolan, She Watched Her Husband Get Sentenced to Death. Now She’s Becoming a Lawyer to

Save Him and Others., Sᴘʟɪɴᴛᴇʀ (Oct. 24, 2016), available at https://splinternews.com/she-watched-herhusband-get-sentenced-to-death-now-she-1793863088 (“Godinich and his second chair attorney didn’t even

meet with Juan until just before the trial, and conducted almost no investigation, Yancy said. … at times during

jury deliberations, neither of Juan's lawyers were present while the judge and prosecutors responded to

questions from the jury by themselves. Hartwell said that when she confronted Godinich, he told her, ‘I have

another trial to take care of.’ (Godinich did not respond to a request for comment.)”)); see also Stephen B.

Bright, Independence of Counsel: An Essential Requirement for Competent Counsel and a Working Adversary

System, 55 Hᴏᴜs. L. Rᴇᴠ. 853, 869 (2018) (“[Jerome Godinich] was assigned 406 felony cases at the trial level

in 2017—more than twice the national standard of 150 felony cases—as well as 8 capital cases, and 7 felony

appeals.”) (citations omitted)).

16

We say proximate cause because we recognize, as critical legal studies scholars have argued, that deeper

societal problems might be common drivers of all of these phenomena. If indeed “prison is for the poor, and

not the rich,” see Butler, supra note __, at 2178, then the whole system of judicial campaign finance might be

another system that was created to be indifferent or even hostile to the interests of the poor.

17

See Michael S. Kang & Joanna M. Shepherd, The Partisan Price of Justice: An Empirical Analysis of

Campaign Contributions and Judicial Decision, 86 N.Y.U L. Rᴇᴠ. 69 (2011) (finding elected state supreme

court justices more likely to rule in favor of business interests as donations from those interests increase);

Joanna M. Shepherd, Money, Politics, and Impartial Justice, 58 Dᴜᴋᴇ L.J. 623 (2009); Damon M. Cann, Justice

for Sale? Campaign Contributions and Judicial Decisionmaking, 7 Sᴛ. Pᴏʟ. & Pᴏʟ. Q. 281 (2007).

3

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

What we find is shocking. Trial judges routinely accept donations from defense attorneys who

practice before them. Worse, judges often accept these donations as an apparent “entry fee” from

counsel soon after they become eligible for indigent defense appointments. And while donor and

non-donor attorneys appear similar in terms of their education and experience, on average, judges

assign their donors more than double the number of cases they assign to non-donors. Such

assignments are flatly inconsistent with the prescribed rotation or “wheel” assignment system

mandated by Texas law.18

In addition, we find these preferential assignment patterns enable donors to earn on average

more than double the total attorneys fees of non-donors. And the total amount of these fees can be

quite significant: the average donor earns $31,081 in attorneys fees from her donee judge.19 Put

another way, if pay to play exists, then our regression analysis suggests the average defense

attorney receives more than a 27-fold “return” on her campaign contributions.20

More troubling, the apparent quid pro quo that we observe might directly harm indigent

defendants. We find that if anything, defense attorneys who donate to judges are less successful

than those who don’t in terms of attaining charge reductions, dismissals, and acquittals, or avoiding

prison sentences for their clients. These results are not driven solely by observable differences in

assigned cases or defendant characteristics, or unobservable differences that remain fixed over

time. We suggest that donor attorneys might underperform simply because they take on so many

more cases from their donee judges, and hence have less time to spend on each matter.21

We also present qualitative evidence based on news reports and interviews with practicing

attorneys in Texas that suggests the phenomena described here are endemic across the state.

Furthermore, we explain why these problems might exist throughout the country, as trial judges in

many other states (including California, Georgia, Maryland, Missouri, North Carolina, and Ohio,

among others) can receive donations from attorneys and control assignments of indigent defense

counsel.22

Some might view our results as yet another nail in the coffin of Gideon—as further proof that

America’s grand experiment with indigent defense is a failure, and that societal forces will ensure

that it continues to be a failure absent sweeping social and political change. Perhaps this is true. But

we argue, more modestly, that our research reveals the more immediate problem is one of

misaligned incentives: as practiced today, no one’s interests are truly aligned with those of indigent

defendants. Instead, assigned counsel are often financially incentivized to dispose of indigent

18

See infra notes __ and accompanying text.

See infra notes __ and accompanying text.

20

To give some perspective on how extraordinary this return is: if you had invested $10,000 in a portfolio that

replicated the S&P 500 in March 2009, at the market low during the Great Recession, and sold in July 2019,

when the market recently peaked, your portfolio would have grown to $48,708.38—just less than a 5-fold

increase. See S&P 500 Periodic Reinvestment Calculator (With Dividends), at https://dqydj.com/sp-500periodic-reinvestment-calculator-dividends/ (last visited Sept. 3, 2019). Moreover, as we explain later, our

return estimates are if anything significantly underestimated, as we have reliable attorney revenue data only

from 2014-2018 and not from earlier years. See infra notes __ and accompanying text.

21

See infra notes __ and accompanying text.

22

See infra notes __ and accompanying text.

19

4

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

defense cases as quickly as possible, with as little effort as possible—motives that line up better with

zealous prosecutors and docket-conscious judges than with the best interests of poor defendants.

We argue that this “incentive gap” is an underappreciated fault at the heart of the right to

counsel. We further explain that while modest reforms to attorney assignment rules and campaign

finance regulations might reduce pay to play, they are unlikely on their own to solve the problem or

substantially improve the lot of poor defendants absent deeper structural changes that alter attorney

incentives.

The next section provides a brief history of indigent defense in the United States, starting

before Gideon and moving to present-day. Section III then overviews the three main models of

indigent defense in America: assigned counsel, contract, and public defender systems. It further

explains how each of these systems creates attorney incentives at odds with those of indigent

defendants. This section also provides qualitative evidence on how campaign finance interacts with

these assignment systems to further distort attorney incentives and widen the incentive gap.

Section IV turns toward empirics. After describing how the dataset was constructed, the

section provides summary statistics, regression specifications, and graphical evidence to show how

pay to play is likely influencing indigent defense appointments in Harris County. Section V briefly

lays out some policy proposals that seek to eliminate pay to play. It further explains why such

proposals are unlikely to be successful or to substantially improve the quality of indigent defense

unless they are also accompanied by deeper structural reforms. A short conclusion then follows.

II.

The Promise and Failure of Gideon: A Brief History of the Right to Counsel

Under the Sixth Amendment

The origins of the right to counsel in the United States begin far before Gideon in 1963.

Twelve of the original thirteen colonies declared some form of this right in early versions of their state

constitutions, despite English common law denying such a right existed.23 The Supreme Court

described this split from the common law in Holden v. Hardy, decided at the turn of the 20th century:

The earlier practice of the common law . . . so far as it deprived him of the assistance of

counsel and compulsory process for the attendance of his witnesses, it had not been

changed in England. But to the credit of her American colonies, let it be said that so

oppressive a doctrine had never obtained a foothold there.24

By the early 20th century, every state “had established the right to have the assistance of

counsel similar to that found in the Sixth Amendment”25 at that time and required the appointment of

counsel in capital cases.26 Nonetheless, the scope of the right was inconsistent across states, with

23

See Powell v. Alabama, 287 U.S. 45, 61-62 (1932).

Holden v. Hardy, 169 U.S. 366, 386 (1898).

25

Sɪxᴛʜ Aᴍ. Cᴛʀ., The Story of the Scottsboro Boys in Powell v. Alabama, at https://sixthamendment.org/theright-to-counsel/history-of-the-right-to-counsel/the-story-of-the-scottsboro-boys/ (citing William Beaney, Tʜᴇ

Rɪɢʜᴛ ᴛᴏ Cᴏᴜɴsᴇʟ ɪɴ Aᴍᴇʀɪᴄᴀɴ Cᴏᴜʀᴛs 19 (U of Mich, 1955)); U.S. Cᴏɴsᴛ., Sɪxᴛʜ Aᴍ. (“In all criminal

prosecutions, the accused shall enjoy the right . . . to have the Assistance of Counsel for his defence.”).

26

Id.

24

5

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

one scholar estimating that by the early 1930’s approximately half of all states had yet to extend the

right to counsel to non-capital cases.27

The calculus on the right to counsel began to shift in 1932 with the U.S. Supreme Court’s

decision in Powell v. Alabama.28 In Powell, the Court overturned the conviction of six young men

charged with rape on the grounds that they had been denied access to counsel.29 The Powell Court

found that in capital cases, the Sixth Amendment right to counsel was a fundamental right

encompassed by the Due Process Clause of the 14th Amendment.30

This “fundamental fairness” test soon became a part of Sixth Amendment jurisprudence. The

Court would next apply it in the context of a federal criminal trial in 1938’s Johnson v. Zerbst.31 In

Johnson, two men facing federal counterfeiting charges were denied access to counsel, ultimately

being convicted and sentenced.32 In overturning the convictions, the Johnson Court definitively

established a right to counsel in all federal criminal proceedings.33

Still, the Court was not yet ready to extend the right to counsel further to encompass state

proceedings. In Betts v. Brady,34 a defendant charged with a non-capital crime in Maryland state

court challenged the court’s refusal to appoint him counsel.35 Rather than require counsel to be

available for indigent defendants in all state criminal proceedings, the Betts Court pointed to the

diversity of access to counsel constitutional provisions and statutes as proof that “in the great majority

of states, it has been the considered judgment of the people, their representatives and their courts

that appointment of counsel is not a fundamental right, essential to a fair trial.”36 The Betts Court then

enumerated a “special circumstances” test as to whether a state had violated a defendant’s due

process rights by denying them access to counsel.37

Many state supreme courts and legislatures responded to Betts by affirming their support for

the right to counsel, and by the late 1950’s, thirty-five states had required counsel be appointed in

27

Sɪxᴛʜ Aᴍ. Cᴛʀ., The Story of the Scottsboro Boys in Powell v. Alabama, at https://sixthamendment.org/theright-to-counsel/history-of-the-right-to-counsel/the-story-of-the-scottsboro-boys/

(citing

Hugh

Richard

Williams, Tʜᴇ Hɪsᴛᴏʀʏ ᴏғ ᴛʜᴇ Rɪɢʜᴛ ᴛᴏ Fʀᴇᴇ Cᴏᴜɴsᴇʟ ɪɴ Aᴍᴇʀɪᴄᴀ 29 (Ill. Univ. Sch. of Law: Fall 2001)).

28

287 U.S. 45 (1932).

29

Id. at 65. After an out-of-state lawyer who had offered to help local counsel refused an appointment to act

as counsel for the defendants, the trial judge then appointed all the members of the local bar as counsel but

neglected to name an individual lawyer to act in that capacity.

30

Id.

31

304 U.S. 458 (1938).

32

Id. at 459-60. The District Attorney in the case denied the men’s request for counsel on the grounds that the

courts in South Carolina (where the trial occurred) did not appoint counsel unless the defendant was charged

with a capital crime.

33

Id. at 467 (“Since the Sixth Amendment constitutionally entitles one charged with crime to the assistance of

counsel, compliance with this constitutional mandate is an essential jurisdictional prerequisite to a federal

court's authority to deprive an accused of his life or liberty.”).

34

316 U.S. 455 (1942).

35

Id. at 456-58.

36

Id. at 467.

37

Id. at 463-64.

6

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

non-capital cases, at least to some degree.38 This affirmation of the right to counsel belied the Betts

Court’s holding that the right was not considered fundamental. And indeed, the Court would revisit

that issue just over 20 years later in Gideon v. Wainwright.39

In Gideon, just as in Betts, the defendant faced felony charges in state court, this time in

Florida.40 As in Betts, the trial court denied the defendant’s request to provide an attorney when the

defendant was unable to hire his own.41 Reversing their decision in Betts, the Gideon Court

unanimously found that the right to counsel was essential to a fair trial in state criminal proceedings,

noting: “[R]eason and reflection require us to recognize that in our adversary system of criminal

justice, any person haled into court, who is too poor to hire a lawyer, cannot be assured a fair trial

unless counsel is provided for him.”42

Writing for the Court, Justice Hugo Black framed the issue in terms of resources and

incentives for all parties involved, noting that government actions and the behavior of wealthy

defendants rendered access to counsel essential for a fair trial:

Governments, both state and federal, quite properly spend vast sums of money to

establish machinery to try defendants accused of crime. Lawyers to prosecute are

everywhere deemed essential to protect the public's interest in an orderly society.

Similarly, there are few defendants charged with crime, few indeed, who fail to hire the

best lawyers they can get to prepare and present their defenses. That government hires

lawyers to prosecute and defendants who have the money hire lawyers to defend are

the strongest indications of the wide-spread belief that lawyers in criminal courts are

necessities, not luxuries. The right of one charged with crime to counsel may not be

deemed fundamental and essential to fair trials in some countries, but it is in ours.43

Justice Black concluded that the ideals of American government necessitated the

appointment of counsel to indigent defendants in state courts:

From the very beginning, our state and national constitutions and laws have laid great

emphasis on procedural and substantive safeguards designed to assure fair trials before

impartial tribunals in which every defendant stands equal before the law. This noble

ideal cannot be realized if the poor man charged with crime has to face his accusers

without a lawyer to assist him.44

38

See Sixth Amendment Center, The Post-Betts Era in the States’ Courts, at https://sixthamendment.org/theright-to-counsel/history-of-the-right-to-counsel/the-post-betts-era/ (citing Wɪʟʟɪᴀᴍ Bᴇᴀɴᴇʏ, Tʜᴇ Rɪɢʜᴛ ᴛᴏ

Cᴏᴜɴsᴇʟ ɪɴ Aᴍᴇʀɪᴄᴀɴ Cᴏᴜʀᴛs (U. Mich. 1955)). See also Stacey L. Reed, A Look Back at Gideon v. Wainwright

after Forty Years: An Examination of the Illusory Sixth Amendment Right to Assistance of Counsel, 52 Dʀᴀᴋᴇ

L. Rᴇᴠ. 47, 51 (2003) (citing Wayne R. LaFave et al., Criminal Procedure § 11.1 (3d ed.2000)).

39

372 U.S. 335 (1963). The Court noted in its decision that 22 states, as amici, argued that Betts was "an

anachronism when handed down," and should now be overruled. Id.

40

Id. at 336-37.

41

Id. at 337.

42

Id. at 344.

43

Id.

44

Id.

7

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

Gideon was warmly received by the public,45 inspiring the award-winning book Gideon’s

Trumpet.46 And in subsequent years, the Court continued to expand the situations in which the right

to counsel was deemed necessary, holding that it attaches from the time of indictment47 to the time

of a defendant’s first appeal.48 The Court subsequently extended the right to probation revocation

hearings49 and juvenile delinquency proceedings.50 Nearly a decade after Gideon, the Court ruled

that the right to counsel attaches in any criminal case resulting in actual imprisonment,51 putting to

rest many questions about Gideon’s scope.

Yet, even the most ardent supporters of Gideon acknowledged that significant resources

would need to be martialed to ensure the right to counsel was actually robust in practice. In a famous

1965 law review article, Henry Monaghan forewarned the coming tension between the promise of

Gideon and the practical and logistical problems that might arise: “Gideon's little regiment had no

real difficulty in running up its colors, but it is quite apparent that an army—a very large one—must

be raised if the victory is to be a lasting one.”52

By the time Gideon’s Trumpet was turned into a popular television movie starring Henry

Fonda in 1980,53 the shortcomings of that decision had become painfully apparent. Many states had

failed to take the steps needed to effectively comply with the ruling. These failures continue today,

with many scholars attributing the continued crisis in access to counsel to weaknesses and

oversights in Gideon itself.

In particular, many scholars argue that a key failure of Gideon was that it did not define, let

alone mandate, what kind of counsel defendants are entitled to. Neither did it define what states

45

See Reed, supra note __.

Anthony Lewis, Gɪᴅᴇᴏɴ's Tʀᴜᴍᴘᴇᴛ. New York: Vintage Books/Random House, 1964.

47

See Massiah v. United States, 377 U.S. 201 (1964); see also Rothgery v. Gillespie County, 554 U.S. 191

(2008) (right to counsel triggered at criminal defendant’s initial appearance before a magistrate judge).

48

See Douglas v. California, 372 U.S. 353 (1963) (a companion case to Gideon); see also Halbert v. Michigan,

545 U.S. 605 (2005) (state may not deny attorney for defendant who seeks to appeal after entering a guilty

plea); Griffin v. Illinois, 351 U.S. 12 (1956) (due process and equal protection require state to pay for trial

transcript for indigent defendant if necessary for defendant’s appeal to be heard).

49

See Mempa v. Rhay, 389 U.S. 128 (1967). More recently, the Court has held that ineffective assistance of

counsel claims can be made based on the plea bargaining process. See Missouri v. Frye, 566 U.S. 134 (2012)

(defense attorneys have a duty to convey plea bargain offers to defendants); Lafler v. Cooper, 566 U.S. 156

(2012) (prosecutor might be required to reoffer plea if defendant originally rejected it due to ineffective

assistance of counsel).

50

In re Gault, 387 U.S. 1 (1967).

51

See Argersinger v. Hamlin, 407 U.S. 25 (1972); see also Scott v. Illinois, 440 U.S. 367 (1979) (clarifying that

the right to counsel is required whenever a defendant was actually sentenced to prison, but not if a prison

sentence was merely authorized under the charging statute); Alabama v. Shelton, 535 U.S. 654 (2002)

(suspended prison sentence may not be imposed if defendant lacked an attorney at trial); see also Shaun

Ossei-Owusu, The Sixth Amendment Façade: The Racial Evolution of the Right to Counsel, 167 U. Pᴀ. L. Rᴇᴠ.

__ (2019) (“During this decade, which saw larger criminal procedure reforms, the Court had the most generous

approach toward indigent defense.”).

52

Henry P. Monaghan, Gideon's Army: Student Soldiers, 45 B.U. L. Rev. 445, 446 (1965).

53

Gideon’s Trumpet. Directed by Robert L. Collins, performances by Henry Fonda, Jose Ferrer, John

Houseman, and Fay Wray, Worldvision Enterprises (1980).

46

8

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

must do to ensure this type of counsel is available for indigent defendants. Put differently, Gideon

gave states considerable freedom to shirk the large unfunded mandate that the case had created.

These issues were exacerbated by subsequent Court decisions, perhaps most notably

Strickland v. Washington.54 There, the Court determined that claims of ineffective assistance of

counsel can succeed only if there were an initial determination that a defense attorney’s performance

was so lacking “that counsel was not functioning as the ‘counsel’ guaranteed the defendant by the

Sixth Amendment.”55 Moreover, the defendant must show the ineffectiveness prejudiced him

severely enough such that there is a reasonable possibility that the outcome of the defendant’s case

would have been different without the deficient performance of counsel.56

Justice Thurgood Marshall noted in his Strickland dissent that this exacting standard would

be hard to meet, since “it is often very difficult to tell whether a defendant convicted after a trial in

which he was ineffectively represented would have fared better if his lawyer had been competent.”57

And he was right: while ineffective assistance of counsel claims are regularly made, they are rarely

successful.58 The end result is that indigent defendants might get stuck with counsel who are not

“ineffective,” but whom paying clients would never select.59

With ineffective assistance claims largely rendered futile, some sought to remedy the

dramatic underfunding of indigent defense through systemic, structural litigation. But the potential for

such federal litigation was limited, as federal courts relied on the abstention doctrine to avoid

intervening in ongoing state cases.60 Structural litigation in state courts has been similarly

unsuccessful, with courts demanding a showing of prejudice or the existence of a conflict on an

54

466 U.S. 668 (1984).

Id. at 687.

56

Id.

57

Id. at 710 (Marshall, J. dissenting).

58

A 2013 analysis found that Supreme Court findings of ineffective assistance of counsel have been virtually

non-existent since Strickland. Erwin Chemerinsky, Lessons from Gideon, 122 Yᴀʟᴇ L.J. 2676, 2689 (2013).

Professor Chemerinsky was able to identify just two Supreme Court findings of ineffective assistance of

counsel in the 25 years following Gideon—Wiggins v. Smith and Rompilla v. Beard, both capital cases. He

also noted that the findings in Wiggins and Rompilla were called into question by the Court’s ruling in Cullen

v. Pinholster, 563 U.S. 170 (2011), which held that evidence of ineffective assistance of counsel could not be

presented at federal habeas proceedings. See also Padilla v. Kentucky, 559 U.S. 356 (2010) (holding that

criminal defense attorneys must inform non-citizen defendants of deportation consequences of guilty pleas).

59

As one private criminal defense firm in Texas colorfully (and probably self-servingly) noted on its website, “If

you’re appointed a lawyer in a criminal case in Texas, your court-appointed lawyer may be an incompetent

hack, or he may be a truly outstanding attorney. Some of the best criminal-defense lawyers in Houston

represent indigent defendants . . .By the same token, if you hire a lawyer for a criminal case in Texas, your

retained lawyer might be either a fine attorney or a bungler.” See Bennett & Bennett, Court Appointed Lawyers,

at https://bennettandbennett.com/about/court-appointed-lawyers/ (last visited Sept. 28, 2019).

60

Chemerinsky at 2687; see also Younger v. Harris, 401 U.S. 37, 43–54 (1971) (federal courts to abstain from

issuing rulings that interfere with ongoing state criminal prosecutions); Margaret A. Costello, Fulfilling the

Unfulfilled Promise of Gideon: Litigation as a Viable Strategic Tool, 99 Iᴏᴡᴀ L. Rᴇᴠ. 1951, 1962 (2014);

Cara H. Drinan, The Third Generation of Indigent Defense Litigation, 33 N.Y.U. Rᴇᴠ. L. & Sᴏᴄ. Cʜᴀɴɢᴇ 427,

438-43 (2009).

55

9

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

individual case-by-case basis from public defenders seeking to remedy funding disparities.61 The

heightened evidentiary requirements have limited the number of structural indigent defense litigation

suits in state courts, with one scholar stating “it is estimated that no more than ten of these suits were

filed between 1980 and 2000.”62

Gideon’s failures have also been pinned on its inability to change underlying power dynamics

and political considerations that adversely affect indigent defendants. In particular, scholars point to

asymmetries in monetary support and available resources for prosecutors and indigent defense

counsel. Prosecutors work closely with law enforcement agencies, whose job is to investigate in

support of prosecution; defense counsel are often left to fend for themselves should they desire to

investigate on behalf of their clients.63 Prosecutors are afforded large budgets dedicated to

investigation; indigent defense attorneys are rarely (if ever) afforded such a luxury.64 And some

judges rely heavily—perhaps inappropriately—on prosecutors, following their recommendations and

even asking prosecutors to write orders for them,65 a benefit that is rarely accorded to counsel

advocating on behalf of indigent defendants.

The politics of mass incarceration in the decades following Gideon have further entrenched

the built-in advantages that prosecutors enjoy over defense counsel. While the 1960’s and 1970’s

brought only moderate increases in the size of America’s criminal justice system, the “tough-oncrime” 1980’s and 1990’s created a system with an incarceration rate higher than any other

industrialized nation.66 The demand for indigent defense likewise exploded, financially straining a

system that was already starved for resources.

The political battle for indigent defense resources that pitted popular tough-on-crime policies

versus poor people accused of crimes was decidedly and expectedly one-sided. As one scholar put

it when discussing capital defendants: “The individuals adversely affected by this crisis—those

accused of aggravated murder—are the most hated and the least politically powerful in the country,

and political actors, including judges, are not highly motivated to make unpopular decisions that

would benefit them.”67 With political considerations weighing heaviest on publicly elected prosecutors

and judges, there was little to gain professionally from insisting on a level playing field.68

61

See Chemerinsky, supra note __ at 2687 (citing Florida v. Public Defender 12 So. 3d 798 (Fla. Dist. Ct. App.

2009)).

62

See Drinan, supra note __, at 468.

63

Id. at 2156. Moreover, discovery is limited in criminal cases, so defendants are also limited in terms of what

information they can obtain from prosecutors and what prosecutors are obligated to disclose to defendants.

See Brady v. Maryland, 373 U.S. 83 (1963).

64

Id.

65

Id.

66

See Chemerinsky at 2686 (citing Michelle Alexander, Tʜᴇ Nᴇᴡ Jɪᴍ Cʀᴏᴡ: Mᴀss Iɴᴄᴀʀᴄᴇʀᴀᴛɪᴏɴ ɪɴ ᴛʜᴇ Aɢᴇ

ᴏғ Cᴏʟᴏʀʙʟɪɴᴅɴᴇss (2012)).

67

Id. (citing Douglas W. Vick, Poorhouse Justice: Underfunded Indigent Defense Services and Arbitrary

Death Sentences, 43 Bᴜғғ. L. Rᴇᴠ. 329, 459 (1995)).

68

Id. at 2157-58. Some scholarly critiques of Gideon also focus on its impact on other criminal procedural

rights. See Justin F. Marceau, Gideon’s Shadow, 122 Yᴀʟᴇ L.J. 2482 (2013) (arguing Gideon has been used

as a cudgel to curb other procedural rights); Pamela Metzger, Fear of Adversariness: Using Gideon to Restrict

Defendants’ Invocation of Adversary Procedures, 122 Yᴀʟᴇ L.J. 2550 (demonstrating how Gideon and

10

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

III.

The Incentive Gap in the Right to Counsel

As we have seen, the long history of the right to counsel is largely defined by false hopes and

unmet expectations. And as is commonly argued, inadequate funding, tepid political support, and

the practical inability of defendants to succeed on most ineffective assistance of counsel claims are

important reasons why indigent defense has not evolved in the way that many advocates hoped it

would after Gideon.

But indigent defense in America doesn’t just suffer from a lack of money or a lack of political

support; it also suffers from poor design.69 Indeed, most indigent defense systems are built on a

shaky foundation that puts publicly funded defense attorneys at odds with those they are supposed

to represent. This incentive gap, in turn, adversely affects the legal representation these defendants

receive.70

In this section, we begin exploring this dynamic. We start by summarizing the different models

of indigent defense adopted by various jurisdictions, and then discussing how they distort attorney

incentives in different ways. Next, we explain how the relationship between judges and defense

attorneys, mediated through the mechanism of campaign finance, exacerbates the incentive gap,

thereby further adversely impacting the provision of indigent defense. Finally, we provide qualitative

evidence that indigent defense attorneys and trial judges might participate in pay to play in a number

of jurisdictions.

A. Background on Indigent Defense Systems

Gideon and its progeny famously failed to direct states on how to provide counsel to poor

defendants, thereby giving them substantial latitude in crafting indigent defense systems. States are

fairly evenly split between administering indigent defense at the local (usually county) level, or at the

state level.71

Strickland have weakened the adversarial process). Others have focused on its failure to adequately protect

black defendants. See, e.g., Gabriel J. Chin, Race and the Disappointing Right to Counsel, 122 Yᴀʟᴇ L.J. 2126,

2236 (2013) (arguing the Gideon court failed to directly address racial discrimination and this failure portended

larger failures to protect the rights of African Americans subject to the Jim Crow system of criminal justice).

Still others suggest Gideon might actually be counterproductive to the plight of the poor in the justice system.

See Butler, supra note __, at __ (“Poor people lose, most of the time, because in American criminal justice,

poor people are losers. Prison is designed for them. This is the real crisis of indigent defense. Gideon obscures

this reality, and in this sense stands in the way of the political mobilization that will be required to transform

criminal justice.”); see also John H. Blume & Sheri Lynn Johnson, Gideon Exceptionalism?, 122 Yᴀʟᴇ L.J. 2126

(2013) (attempting to reconcile the state of indigent defense in America with the general reverence for Gideon

by declaring it to be both a “shining city on a hill” . . . and a sham.”).

69

Of course, these phenomena might be interrelated—for example, some poor design choices in indigent

defense systems might be deliberately made by those looking to render the system impotent. And a lack of

funding is one way to make sure that poor design leads to worse outcomes.

70

A rare paper that does look at how assigned counsel incentives are affected by payment systems is Benjamin

Schwall, More Bang for Your Buck: How to Improve the Incentive Structure for Indigent Defense Counsel, 14

Oʜɪᴏ Sᴛ. J. Cʀɪᴍ. L. 553 (2017).

71

See Suzanne M. Strong, State-Administered Indigent Defense Systems, 2013, Bureau of Justice Statistics

(Nov. 2016) (“In 2013, 28 states and the District of Columbia had state-administered indigent defense programs

for the delivery of criminal defense services.”).

11

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

Jurisdictions also are split among three different models of representation: assigned counsel,

contract, and public defender.72 Each of these models is commonly used in the United States. Public

defender systems are used most often in larger cities, whereas assigned counsel systems are used

in the most jurisdictions overall, particularly in rural parts of the country. We describe each of these

systems below.

1. Assigned Counsel

Assigned counsel systems rely on private attorneys to represent indigent defendants.73 The

oldest model is the “Ad Hoc Assigned Counsel” system,74 where “appointment of counsel is generally

made by the court, without benefit of a formal list or rotation method and without specific qualification

criteria for attorneys.”75 Popular in smaller, more rural jurisdictions, ad hoc assigned counsel systems

are frequently criticized “for fostering patronage and lacking control over the experience level of

qualified attorneys.”76

Other iterations of assigned counsel systems address some, but not all, of the ad hoc model’s

shortcomings. One such system is sometimes referred to as the “wheel” system, in which “private

attorneys, acting as independent contractors and compensated with public funds, are individually

appointed from a list of qualified attorneys using a system of rotation to provide legal representation

and service to a particular indigent defendant accused of a crime or juvenile offense.”77 Wheel and

ad hoc assigned counsel systems generally require attorneys to petition the court for any caserelated expenses, including funds for investigation, expert witnesses, and other litigation costs.

These expenses often requires prior approval from the court and are limited by a maximum, courtdetermined payout.78

The last distinct form of assigned counsel system is known as a managed or coordinated

assigned counsel program. Rather than let the judge select an indigent defense attorney, this

decision is left to an independent body, such as “a governmental entity, nonprofit corporation, or bar

association operating under a written agreement with a county for the purpose of appointing counsel

to indigent defendants.”79 Such systems are the rarest of assigned counsel systems, largely due to

the additional administrative burdens that accompany them.80

72

Id. at 32.

Id.

74

Id. at 33.

75

Id.

76

Id.

77

Tx Iɴᴅɪɢᴇɴᴛ Dᴇғ. Cᴏᴍᴍ., Primer on Managed Assigned Counsel Programs (Sept. 2017), at

http://www.tidc.texas.gov/media/57815/tidc_primer2017.pdf, p.3; see also Scott Ehlers, Texas Indigent

73

Defense Commission: “Challenges of Implementing Fair Defense Act Requirements & Indigent Defense Grant

Opportunities” (Aug. 10, 2018). As discussed in more detail below, Harris County, Texas, where we conduct

our empirical analysis, is supposed to be a “wheel” jurisdiction. See infra notes __ and accompanying text.

78

Spangenberg, supra note __ at 33.

Tx Iɴᴅɪɢᴇɴᴛ Dᴇғ. Cᴏᴍᴍ., Primer on Managed Assigned Counsel Programs, supra.

80

See Spangenberg, supra note __ at 33.

79

12

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

2. Contract Attorneys

Contract programs differ from assigned counsel systems in that the jurisdiction “enters into

contracts with private attorneys, law firms, bar associations, or non-profit organizations to provide

representation to indigent defendants.”81 Still, in practice, many modern contract systems operate

like assigned counsel systems, with the most significant difference being that there is no rotation

requirement among attorneys in a contract system.82

An early model of contract attorney systems was the fixed price contract model, where “the

contracting lawyer, law firm, or bar association agrees to accept an undetermined number of cases

within an agreed upon contract period . . . for a single flat fee.”83 In a fixed-price contract model, the

contracting entities are responsible for the cost of investigation and expert witnesses in all the cases,

even if the caseload in the jurisdiction was higher than expected for the term of the contract.84 Fixedprice contract models are frequently faulted for their failure to take into account the time that the

attorney is expected to spend representing indigent clients, the competency of the attorney, the

complexity of the case, or the lack of support costs provided to the attorney.85

Another older model of contract attorney program is known as the fixed-fee-per-case contract

model, in which lawyers are paid by the case rather than contracting to provide an unlimited number

of cases for a flat fee.86 In this model, funds for investigation, expert witnesses, and support services

are all included in the contract.87 Just as with the fixed price model, the fixed-fee-per-case model has

been criticized for its lack of quality control.88 Nonetheless, jurisdictions are often willing to overlook

the shaky legal and ethical footing of a contract attorney system to reap the benefit of being able to

project costs by limiting the amount of money apportioned in each contract.89

3. Public Defenders

Finally, public defender systems are probably the best-known model of indigent defense

provision. Such systems employ staff attorneys who are paid a fixed salary to provide representation

to poor defendants.90 More precisely, public defender systems are often defined as “a governmental

entity or nonprofit corporation that: 1) operates under written agreement with a county rather than an

individual judge or court; 2) uses public funds; and 3) provides legal representation and services to

indigent defendants accused of a crime or juvenile offense.”91

81

Id. at 34.

Tx Iɴᴅɪɢᴇɴᴛ Dᴇғ. Cᴏᴍᴍ., Primer on Managed Assigned Counsel Programs, supra at 3.

83

Id.

84

Id.

85

Id., citing State v. Smith, 681 P.2d 1374 (Ariz. 1984), where the Arizona Supreme Court found that the fixedprice contract models used in several Arizona Counties were unconstitutional.

86

Id.

87

Id.

88

Id.

89

Id.

90

Spangenberg at 36.

91

Scott Ehlers, Tᴇxᴀs Iɴᴅɪɢᴇɴᴛ Dᴇғᴇɴsᴇ Cᴏᴍᴍɪssɪᴏɴ: “Challenges of Implementing Fair Defense Act

82

Requirements & Indigent Defense Grant Opportunities,” August 10, 2018.

13

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

The first public defender program started in Los Angeles in 1913, but the model did not gain

widespread popularity until after Gideon and after national studies were published that supported

this approach in the 1970’s.92 Unfortunately, the increased demand for indigent defense services

beginning in the 1980’s means that many public defenders carry overwhelmingly large caseloads,

sometimes resulting in ineffective representation.93

In addition, some jurisdictions use public defenders alongside assigned counsel or contract

attorneys.94 This might be, for example, because there are insufficient numbers of public defenders

who are able to handle the flow of indigent defense cases. In some instances, public defenders

handle only a small fraction of such cases; as discussed in more detail below, Harris County, Texas,

is an example of one such jurisdiction.

B. Different Systems, Different Incentives

Apart from being poor and typically young and male, indigent defendants differ from one

another in myriad ways, such as in terms of their backgrounds, criminal histories, employment and

family status, risk preferences, and crimes for which they are charged. Still, most defendants,

whether poor or not, invariably share some predictable goals. Clearly most would like to avoid a

criminal conviction and punishment; failing that, they want to minimize any punishment they receive,

whether in terms of prison, probation, or fines. And like most people, indigent defendants would like

to avoid pre-trial detention regardless of outcome.

Defense attorneys who represent indigent defendants also share some predictable goals.

Some of those goals might align with those of their clients—for example, a desire to win a case or to

vindicate the rights of the innocent who are wrongfully accused of a crime. Other goals, however,

might not be so compatible. This in turn might open up an “incentive gap” that causes attorneys to

behave in ways that are detrimental to their clients.

This incentive gap is shaped by the particular indigent defense system in which attorneys

operate.95 As such, how this system is designed might affect, among other things: how many cases

attorneys choose to take on; how much time and resources attorneys spend on each case they are

assigned; when and whether an attorney recommends settling a case to a client and on what terms;

and the quality of lawyer who chooses to participate in such a system in the first place. We explore

these issues in more detail below.

1. Caseload Incentives for Assigned Counsel and Contract Attorneys

First, and perhaps most importantly, the design of an indigent defense system can affect

attorneys’ incentives when it comes to the size of their caseloads. In all assigned counsel and many

92

Spangenberg at 36.

Id. at 36-37.

94

See, e.g., James M. Anderson & Paul Heaton, How Much Difference Does the Lawyer Make? The Effect

Of Defense Counsel on Murder Case Outcomes, 122 Yᴀʟᴇ L.J. 154 (2012) (one in five murder defendants in

Philadelphia were randomly assigned a public defender; the rest received assigned counsel).

95

See Schwall, supra note __, at 553 (recognizing that “[t]he payment system and related incentive structure

can have a major effect on an attorney's behavior, and this impact is somewhat predictable.”).

93

14

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

contract attorney systems, payments to an attorney typically bear some relation to the number of

cases that the attorney is assigned. The payment might be, for example, a flat fee for each case that

is assigned, a flat fee for each court appearance or day worked on a case, or an hourly fee for time

worked on a case. Such systems often include caps on the maximum amount an attorney can be

paid on a particular matter.

Consider first a jurisdiction in which an attorney is paid a flat fee for each case he is assigned,

as is done in some assigned counsel and contract attorney systems96 If the flat fee is too low to

justify taking a case—such as, for example, if the attorney has more profitable outside options for

her time—then the attorney will choose not to take the case. But if the flat fee is large enough, we

can immediately see that the attorney will have an incentive to take on a large number of cases,

since each case adds to his revenue without significantly increasing costs.97 By contrast, working

more intensely on any one particular case gives the attorney no additional revenue, since he is being

compensated a fixed amount regardless of his effort or the case’s outcome. So we might expect

paying attorneys a flat fee per case would push them toward large caseloads for which they exert

little effort on any one case. In addition, we might expect attorneys to settle cases quickly, since

additional time spent on a case is just wasted from a financial perspective.

Note a paradox that emerges here: on the surface, it might seem that the large number of

cases assigned to these attorneys is the primary reason why they are unable to spend much time or

exert much effort on any one case. But the real reason these attorneys are overextended is that they

have chosen to accept an overload of cases in the first place. In this setting, it is not a lack of funds

but the poor design of the indigent defense system itself that is driving the dysfunction.

While the per-case payment scheme might be an obvious example of how a large incentive

gap might open up between attorney and client, other payment schemes introduce distortions in less

obvious ways. For example, consider when attorneys are paid based on the number of days they

spend on a case. This is, for example, how assigned counsel in Harris County, Texas, are paid, as

demonstrated in a fee table for an actual case, shown in Figure 1 below. We can see the attorney in

this case was paid $125/day for each court appearance, regardless of how long he actually spent in

court on the case itself (or regardless of how many other cases he might have handled on those

same days). Those five court appearances entitled the attorney to a total of $625 in attorneys fees.

96

In this example, and the others that follow, assume that the underlying cases are otherwise identical and

that an attorney is motivated largely, if not exclusively, by financial gain. That is, the attorney seeks to maximize

the total revenue she earns net of costs across all indigent defense cases she takes on. Attorneys in the real

world are of course not one-dimensional like this; nonetheless, our empirical analysis suggests attorneys do

respond to financial incentives, indicating the profit motive is an important determinant of attorney behavior.

97

This assumes the cost of working on a case goes up linearly as well; if costs increase in a non-linear manner,

then the attorney will eventually reach a point where adding an additional case will be more costly than the

revenue she earns from it. The general point still holds, however, that the attorney will have an incentive to

take on more cases until she reaches that point.

15

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

Figure 1

At first glance, a pay-per-day system might seem like it benefits clients, since an attorney has

an incentive to spend many days on each case, thereby increasing total wages. Nonetheless, this

incentive does not necessarily help a defendant for at least two reasons.

First, like the system where attorneys are paid by the case, attorneys under this system still

earn more money if they maximize the number of cases they take on. This, once again, leads to

concerns about defense attorneys choosing to accept an excessive workload.

Second, a daily payment system encourages attorneys to “touch” as many case files as

possible in a single day, to ensure they are eligible to be paid for that day. But the amount of work

they spent on each case might be minimal. The optimal strategy for an attorney seeking to maximize

revenues and to minimize effort is to barely do any work on a case on any given day, but to spread

this minimal work out over many days. Again, this does not work to the benefit of indigent defendants.

In fact, it could even be detrimental to a defendant who is incarcerated while awaiting trial: not only

does the attorney have little incentive to spend quality time on a defendant’s case, but now she has

an incentive to drag the case out while her client languishes in jail.

An hourly payment system would seem preferable to these two alternatives. Here, an

attorney is paid based on the amount of time she spends on a case. There is, at first glance, no

incentive to take on more cases—you can spend more time on the same case and earn the same

16

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

marginal revenue as you would by taking on a new one.98 It might even be better to work more on

an existing case, since there are fixed costs in picking up a new matter that might make it more

onerous than working an additional hour on a case that you’re already familiar with.

Again, in practice, this system does not work as well as one might hope. While in theory an

hourly system would incentivize attorneys to put in more effort on a particular case, there are typically

caps on what an attorney can charge for that case. Once an attorney reaches that cap, she has little

incentive to put in more work on that case and instead gains more revenue by seeking out fresh

cases. Hence, in practice, defense attorneys in assigned counsel systems still have incentives to

maximize their caseloads even when they are paid by the hour.

2. Caseload Incentives for Public Defenders

One might view these distortions as proof that the best way to provide indigent defense is

through a pure public defender system for all indigent defendants. Unlike assigned counsel systems,

salaries for a public defender do not depend on the number of cases they are assigned; hence, from

a financial perspective, there is no incentive to take on an excessive number of cases. And there is

some empirical evidence that suggests public defenders do, in fact, outperform assigned counsel in

terms of outcomes for criminal defendants.99

Unfortunately, public defenders must deal with a different set of forces that also push their

incentives away from those of their clients. While public defenders have no financial incentive to take

on additional cases, they often have little control over the number of cases they are assigned. If a

public defender’s office is understaffed—as is invariably true in jurisdictions across the United

States—then the supply of public defenders is insufficient to meet the influx of indigent criminal

defendants who need representation. Faced with a flood of cases, public defenders are forced to

apportion their time among those cases.100 And once again, that creates pressure to dispose of

98

There is some empirical evidence to support this point. See Schwall, supra note __, at __ (showing that

South Carolina attorneys put in less effort after a shift from hourly payments to a flat-fee system).

99

See James M. Anderson & Paul Heaton, How Much Difference Does the Lawyer Make? The Effect

Of Defense Counsel on Murder Case Outcomes, 122 Yᴀʟᴇ L.J. 154 (2012) (exploiting random assignment of

indigent murder defendants in Philadelphia to public defenders and court appointed private attorneys and

finding public defenders “reduce their clients’ murder conviction rate by 19% and lower the probability that their

clients receive a life sentence by 62%,” as well as “reducing overall expected time served in prison by 24%.”);

Radha Iyengar, An Analysis of the Performance of Federal Indigent Defense Counsel, NBER Working Paper

No. 13187 (June 2007) (exploiting random case assignment to determine that salaried federal public defenders

outperform appointed private who are compensated hourly in terms of conviction rates and sentence lengths);

see also David S. Abrams & Albert H. Yoon, The Luck of the Draw: Using Random Case Assignment to

Investigate Attorney Ability, 74 U. Cʜɪ. L. Rᴇᴠ. 1145 (2007) (exploiting random assignment in Las Vegas, NV,

and finding that being assigned a “veteran public defender with ten years of experience reduces the average

length of incarceration by 17 percent relative to a public defender in her first year.”); Fabelo, Harris County

Public Defender Survey.

100

For an eye-opening discussion on the problems facing public defender’s offices nationwide, watch Last

Week Tonight with John Oliver: Public Defenders (Sept. 13, 2015), available at

https://youtu.be/USkEzLuzmZ4.

17

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

cases quickly—or at least quicker and with less substantive investigation than if time were not a

worry.101

That public defenders are not immune from such time pressures has not gone unnoticed by

commentators and scholars.102 Notably, the American Bar Association (ABA) has addressed the

issue head on,103 stating explicitly in a report on the matter that “defender organizations, individual

defenders, assigned counsel or contractors for services . . . must take such steps as may be

appropriate to reduce their pending or projected caseloads, including the refusal of further

appointments” when they find accepting new cases or continuing with old cases “will lead to the

furnishing of representation lacking in quality or to the breach of professional obligations.”104

3. Private Attorneys

Now contrast the incentives of publicly funded attorneys with those of private attorneys—

lawyers who represent private-paying clients. The two primary models by which private attorneys

are paid are through up-front fees, in which the attorney asks a prospective client to pre-pay for

criminal defense representation, and a retainer system in which the client pays money up front into

escrow, with funds deducted from the account and transferred to the attorney as she racks up hours

on the defendant’s case. The pre-payment model is commonly used for lower stakes or more routine

cases; the retainer model is commonly used for more complex criminal cases.

The pre-payment model is like the per-case payment model described for assigned counsel;

hence, private counsel have an incentive to take on a large number of cases just like assigned

counsel do in that setting. The retainer model does not include this kind of distortion, since the

attorney is paid for each hour worked regardless of which case she works on.105

Private attorneys, like most assigned counsel, have significant control over the number of

cases they accept. But unlike assigned counsel, private attorneys do not face the same financial

incentives to take on an overwhelming number of cases. This is because private attorneys typically

operate in a market with other competing defense attorneys.

101

Worse, some have argued that given this excessive caseload, implicit bias may cause public defenders to

“triage” their caseload in ways that hurt stigmatized groups such as black defendants. See L. Song Richardson

& Phillip Atiba Goff, Implicit Racial Bias in Public Defender Triage, 122 Yᴀʟᴇ L.J. 2626 (2013).

102

Professor David Luban vividly captures the setting in which most public defenders and panel attorneys

operate: “a world of lawyers for whom no defense at all, rather than aggressive defense or even desultory

defense, is the norm; a world of minuscule acquittal rates; a world where advocacy is rare and defense

investigation virtually nonexistent; a world where lawyers spend minutes, rather than hours, with their clients;

a world in which individualized scrutiny is replaced by the indifferent mass-processing of interchangeable

defendants.” See David Luban, Are Criminal Defendants Different? 91 Mɪᴄʜ L. Rᴇᴠ. 1729 (1993).

103

See, e.g., Securing Reasonable Caseloads: Ethics and Law in Public Defense. Norman Lefstein 2011.

104

See, e.g., id. Standard 5-5. As noted in its report, the ABA intentionally used the word “must” in referring to

the need to take appropriate action when caseloads become excessive, rather than the word “should,” which

is used for all of the remaining standards from the same chapter. Id. at 38. ABA Standard 5-5 has largely

remained unchanged since it was first issued in 1980, though the issue might be revisited in future ABA

releases. Id. at 37

105

Of course, the attorney might have an incentive to overcharge in this setting by working maximally on tasks

that are “easiest,” thereby minimizing effort but that maximizing revenue.

18

Electronic copy available at: https://ssrn.com/abstract=3611209

70 DUKE L.J. __ (2020) (forthcoming)

If a private attorney fleeces a client, or attains bad results for him, this might adversely affect

her reputation and future clients might be less likely to hire that attorney.106 To the extent the market

serves as a disciplining force, it constrains private attorneys from acting too far out of line from their

clients’ interest. Since attorneys who are overloaded cannot represent their clients as effectively as

those are not, this market force constrains the number of cases that private attorneys are likely to

take on.107

By contrast, no such market force exists to discipline counsel in indigent defense cases,

whether assigned, contract, or public defender. Since indigent defendants are told who their lawyer

is rather than given the ability to select who should represent them, they are typically at the whim or

whomever is chosen by a court or independent body as their representative. And as we shall see

below, that attorney might be far from randomly chosen and instead be determined based on

financial forces that have little regard for a defendant’s well-being or best interests.

C. The Incentive Gap Magnified: Campaign Finance and Pay to Play

As we have seen, assigned counsel and some contract attorneys have financial incentives

to amass large numbers of indigent defense cases in order to maximize their revenues. But this can

happen, of course, only if the indigent defense system assigns them those cases in the first place.

In theory, we would expect a well-functioning system to limit the number of appointments that

assigned counsel can accept. While attorneys would still have incentives to “max out” this limit, if the

ceiling is set low enough, then presumably the attorneys would have sufficient time to devote to each

of their cases (assuming they were inclined to do this in the first place).

The assignment system fails, however, if counsel can exert control over how many cases

they are assigned. And unfortunately, this appears to be happening with regularity in many assigned

counsel systems. Anecdotal evidence we have collected suggests indigent defense counsel often

“buy” case assignments by providing campaign donations to assigning judges. In this section, we

describe this evidence, which comprises news articles and interviews we have conducted with

attorneys in Texas and other states. Campaign finance appears to be a tool that magnifies the

incentive gap in these jurisdictions.

1. Attorney Donations and Indigent Defense in Texas

Harris County, Texas, has struggled with indigent defense case assignments for over two

decades. Then-State Senator Rodney Ellis, now County Commissioner for Precinct 1 in Harris